Construction Tips, News & Best Practices

How to Master Construction Project Finance?

Do you control which cost category in your projects you spend the most on? Do you know the project’s net value before its execution starts? Or how much are your liabilities and claims? If not, it might seem that you do not have control over project finance! Check out our article and learn all you should know about proper financial management!

Anyone who has ever managed a company or was responsible for the financial processes knows that it is not a piece of cake. Making all the payments on time, monitoring and managing costs, finishing projects on budget - these are only a few construction financial management challenges.

If you are looking for solutions and tips for improving your project finances, you are in a good place. Today, we want to focus on your company's financials, giving you a package of project management knowledge. However, there is a chance that some of the tips will not be 100% suitable for your needs. If you need a more personal approach to your company’s financial challenges, do not hesitate to contact us.

What is Project Financial Management?

Financial management means all actions in the project (or company) that require the use of the company’s financial resources. It means almost all processes, from small purchases to significant decisions about costly investments.

The 3 main aspects of financial management are:

the cost of projects

the potential returns from products and services that the company offers

the ratio between these two, which indicates the company’s financial stability and the possibility of new investments

When it comes to companies from the construction sector, we need to add one more critical aspect of project finance: late payments. When it comes to subtractors, the usual waiting time to get paid can vary between 40 to even 60 days! If you face this issue in your company, proper financial management can help maintain financial stability while waiting for payment.

Check out to learn more: Construction Financial Management in 2022: The Ultimate Guide

What are the Main Steps in Project Financial Management?

To properly take care of a company's finance, we have to establish proper project financial execution.

- 01

Budget Plan

If your company operates on a strict sum of money per specific project, it is worth creating a budget plan first. To create a reasonable plan, set a minimum and maximum sum of money that you can spend on the project. It will give you proper frames for defining project profitability. Remember to do that before the project starts as once the first cost appears, you will be more likely to increase the maximum limit.

However, the budget is not only about the final cost. Before the work starts, it is good to split the project into the main cost categories, such as materials, design, labour (or any other you need). Thanks to that, you will be able to classify the costs during the execution and see on which part of the project you lose the most significant sum of money. - 02

Quotes

Stage two is a quotation process. It is also called BOQ (Bill of Quantities) or BOM (Bill of Materials) in the construction industry. No matter what your company calls it, during this process, you should estimate the project value. The best way to do it is to prepare a two-faced quote. What does it mean? The quotation has two sides: one with prices for your customer and the other one with wholesale prices for internal use. The difference between them is your profit. As in the previous point, establishing costs and project value gives you a clear view of the project profitability. - 03

Purchase Orders

Do you sometimes feel like coordinating the delivery of materials and the project's time schedule is almost impossible? Materials often come too late or it turns out that they are not exactly like the ones we wanted. Badly managed purchase orders significantly impact not only delivery date but also the project’s financial situation as uncontrolled purchases are not good for your budget.

What is the solution then? Well, a good dashboard with detailed data and procurement adjusted to the project's schedule might help. Always try to register what was already ordered, delivered and which items are still in the waiting queue. Thanks to that, you will avoid unnecessary expenses and decrease the chances of downtime due to a lack of necessary materials. - 04

Financial Documentation

Organised documentation is a key for project finance under control. All financial documents, such as purchase invoices, sales invoices and credit notes, should be stored in a separate, easily accessible place. It can be an office but we recommend you have them online (on Google Drive or Document Management Software) as paper documents are often at greater risk of being lost or damaged. Also, if you keep them online, make sure your accountants have access to them. That will speed up the work and decrease the need for additional communication. - 05

Reports

Fast information flow is crucial for successful project management. Also, when it comes to project financials. Even before the work starts, try to establish the essential data that you need to have a view on and a place (a table in Excel or again, a project management system), where you will store all that.

Also, for better communication, establish with your team how you will share crucial information. It can be done by report, separate channel or actually, anything that works for your team. Thanks to that, if something threatens your project, there is a chance you will know about it earlier and will be able to react faster. - 06

Payments

Last but not least, it is time for payments. Remember to always look at two figures: liabilities (so the money you owe to vendors/subcontractors) and claims (the money that customers/general contractors owe you).

As we mentioned before, subcontractors often have to wait even 60 days for a full payment. That is why it is crucial to control the ratio between claims and liabilities in order not to lose financial stability. So, our piece of advice here would be to create a valuation report as soon as the project is done and send it directly to the client to increase the chance of faster payment.

Learn more about project finance steps

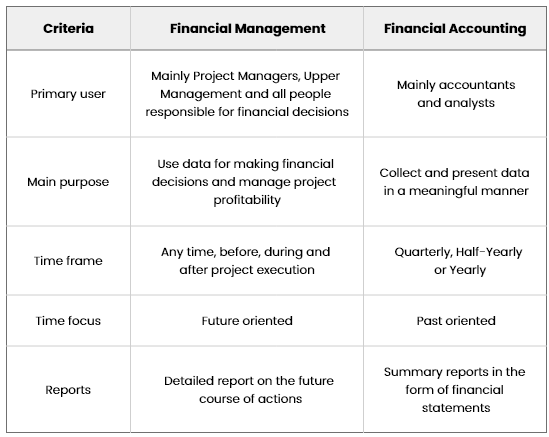

How is Financial Management Different From Financial Accounting

Did you know that financial and accounting management are two different processes? However, both are very similar, so we put the main differences in the table below to make it more transparent.

Source: https://www.educba.com/accounting-vs-financial-management/

Financial Manager - Why Does Your Company Need It?

As you can see above, financial and accounting processes are pretty different. That is why, if financial operations in your company are pretty complex, do not expect that your accountants will manage them all.

Okay, you may think, so if not accountants, how about a project manager if my finances are closely related to the project execution? Of course, a project manager must understand the financial aspects of the project and monitor costs to fit into a given budget. However, the project manager's primary role is to coordinate the work of the whole team and assure smooth information flow. It is better not to mix different kinds of responsibilities as proper communication is another crucial factor in project completion.

So if not accountants and not project managers then who? Many companies decide to create a separate role of financial manager in the company (or the project if they are really complex). Such a person is in charge of controlling whether financial resources are used wisely. What does it exactly mean? We can divide four primary areas of their responsibilities:

Track how the company's resources are being used

Monitor and control the balance between costs and profits to assure profitability

Manage company's cash flows

Make financial decisions based on up-to-date information and economic prognosis

Challenges and Opportunities of Proper Financial Management

Organised financial management has some significant benefits. Clarity of costs and explicit profits supported by relevant documentation gives you a clear view of your finances and consequently, the feeling of financial stability. It also gives you the possibility to plan and invest based on detailed data. As a result, you do not have to stress or wonder if your company will make it to the next month.

However, it is essential to remember that no tools, best systems or external specialists will save your company if it is in a bad financial situation. Unfortunately, some managers fall into the trap of some magical solutions that will save their company immediately. Unfortunately, taking care of construction finances takes time and effort. But it is a must for any company's further existence.

How Can You Support Your Financial Management?

No external tools can save your company if it is in a financial crisis. However, proper systems with suitable solutions can significantly improve financial management. And nowadays, you can choose from a wide variety of digital solutions on the market. Of course, the first one that comes to our mind is Excel. But, Excel spreadsheets might not be enough if your company manages more complex processes or many projects simultaneously.

For proper financial management, many companies choose project management software. It offers a variety of tools that can help you monitor the financial health of your projects. Usually, the financial situation is calculated in real-time, thanks to which you can see anytime how your projects are doing.

Another tool often used by construction companies is a specialistic accounting system. As we mentioned before, financial management and financial accounting are two different processes. So, to properly take care of both of them, the best solution would be to invest in project management software, which can integrate with accounting software so that the work isn’t duplicated.

How to Effectively Manage Finances?

As you can see, managing your project finance is a key to the company's profitability and, at the same time, a huge challenge for every manager. We hope that our article gave you at least a brief idea of what you can improve to support your financial management processes.

Remember: The best solutions are the ones customised to your company's needs and reality. If you feel like your company faces some individual challenges that we did not mention in the article, do not hesitate to contact us. Our consultants will be eager to help you and propose the best solutions for your individual needs.

Also, if you want to broaden your knowledge about financial challenges and solutions for construction companies, check out our other articles.

On Time and On Budget!: The True Challenges of Completing any Construction Project

Budgeting Under Control with Archdesk: Manage Your Costs Effectively

You might also like

February 29, 2024 • 7 min read

Utilizing the human-first approach to construction projects to drive higher results.

July 3, 2023 • 6 min read

8 Best Construction Drawing Management Software (2023): A Comprehensive Guide

Find all the information you need about the construction drawing management software tools available on ...June 14, 2023 • 6 min read

The 11 Best PlanGrid Alternatives (2023)

Looking for a great alternative to PlanGrid software? Check out the 11 best construction software tools ...June 14, 2023 • 4 min read

How to win at CIS 340 and make taxes a breeze

CIS 340 is a legal obligation for contractors. But getting it right isn’t straightforward. Want ...