Alright, let's talk turkey. If you're a CFO in the construction game, you know project budgeting can feel like wrestling an octopus in a phone booth. You've got moving targets, shifting costs, and a constant battle to get accurate numbers. This isn't about fancy theories; it's about getting a real grip on your Financial Planning & Analysis (FP&A) so you can make smart calls, fast. That's where Archdesk comes in. It's built by construction folks, for construction folks, to handle the messy reality of our industry and give you the financial clarity you need, often in minutes, not days.

Key Takeaways: What Archdesk Brings to Your Bottom Line

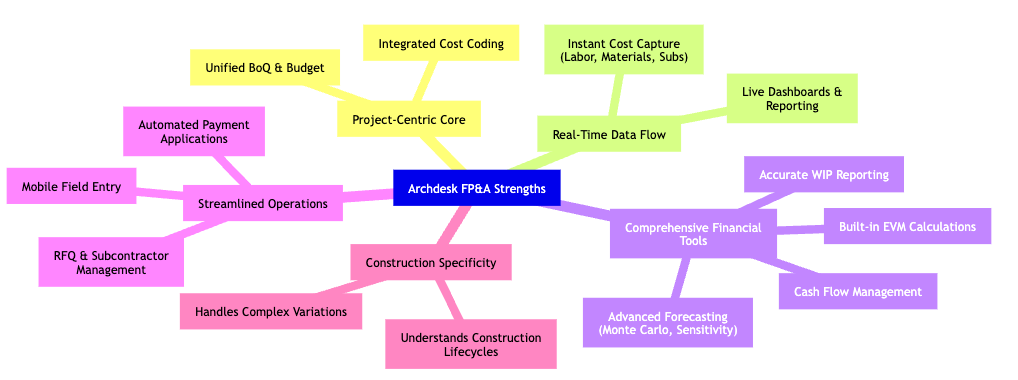

- Real-Time Financial Control: See exactly where your money is going, live, as it happens. No more waiting for month-end reports to spot trouble.

- Streamlined Project Workflow: From initial bid to final payment, Archdesk connects every financial touchpoint back to your project and cost codes.

- Accurate Forecasting & Reporting: Make informed decisions with powerful forecasting tools, Earned Value Management, and clear WIP & cash flow insights.

Archdesk's Core FP&A Engine: A Project-Centric Approach

It All Starts with the Project

In Archdesk, everything revolves around your project. Forget disconnected systems; this is about a single source of truth. Here’s how it works from the ground up:

1. Setting the Stage: Bill of Quantities (BoQ) & Cost Coding

Once a project is initiated, the first step is building out your Bill of Quantities (BoQ). Think of this as the financial DNA of your project. Every single item, whether it's a bag of cement or an hour of skilled labor, is listed. Crucially, each BoQ item is linked to a specific cost coding structure. This might be based on CSI divisions, internal cost centers, or whatever system makes sense for your business. This coding is the backbone for tracking every penny spent against what was planned.

Example (US): A general contractor in Texas building a new commercial complex uses Archdesk to assign cost codes from the 16 CSI MasterFormat divisions to each BoQ line item. This allows them to track, say, all 'Division 03 - Concrete' costs separately from 'Division 09 - Finishes', regardless of which subcontractor or internal team performs the work.

Visualizing project tasks and timelines within Archdesk.

2. Managing Subcontractors: The RFQ Process

For parts of the job you're not handling in-house, Archdesk has a built-in Request for Quotation (RFQ) process. You can flag BoQ items for subcontracting, send out RFQs to your preferred suppliers, compare their bids, and award the work—all within the system. This keeps everything organized and transparent.

3. From Award to Action: Budget, Scope, and Delivery

Once you've won the job and the client gives the green light, your BoQ effectively becomes your baseline budget. The scope of work is now clearly defined. Archdesk then handles two main paths for getting the work done:

- Self-Delivery: If your own crews are doing the work, the relevant scope items automatically populate your project program or schedule. Your team on site can then clock in their hours directly against these tasks using mobile devices. This means labor costs are captured in real-time and tied back to the specific cost codes. Site supervisors can also provide progress updates, feeding live data back into the system.

- Subcontracting: If you're using subcontractors, you issue formal subcontracting agreements through Archdesk. As they complete stages of work, they'll submit valuations or applications for payment. You can review and approve these applications within Archdesk. When their invoices arrive, they are matched against the approved valuations and, again, tracked against the original cost codes.

4. The Power of Now: Real-Time Cost Control

This is where the magic happens. Whether it's labor hours from your team, materials purchased, or an approved subcontractor invoice, every financial transaction is instantly recorded and allocated against the correct cost code and budget line item. You're not waiting weeks for reports; you have a live, dynamic view of your project's financial health. You can see actuals versus budget, identify potential overruns early, and take corrective action before small problems become big ones.

Example (UK): A fit-out specialist in London working on a multi-floor office refurbishment uses Archdesk. Their site manager approves a subcontractor's application for payment for the first-floor electrical work. Instantly, the CFO sees this cost reflected against the 'Electrical Installation - First Floor' cost code, and the project's overall budget status is updated. If this pushes electricals over budget, an alert can be triggered.

Sharpening Your Crystal Ball: Forecasting with Archdesk

Looking Beyond Today's Costs

Tracking current spending is vital, but true financial control means looking ahead. Construction is full of uncertainties, making accurate forecasting essential. Archdesk supports various methods to help you predict future performance and make proactive adjustments.

Key Forecasting Methods in Construction

Here are some common techniques that can be applied within a system like Archdesk:

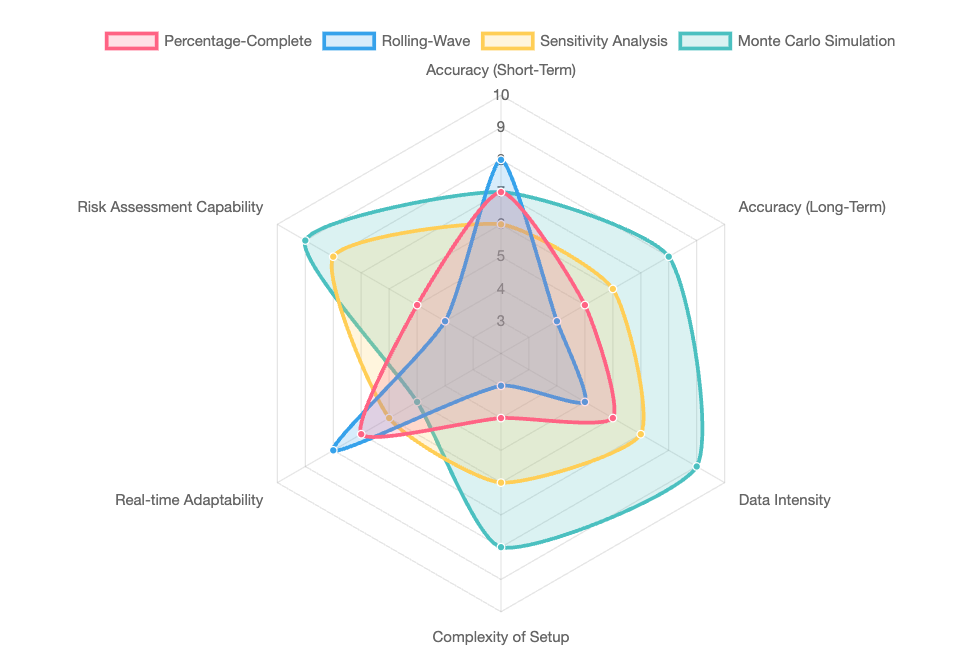

Percentage-Complete Forecast

This method often uses a cost-to-complete calculation. For example, Forecasted Cost = Actual Cost To Date + (Budgeted Cost At Completion – Actual Cost To Date) × (1 – Percentage Complete). It gives a straightforward projection based on current progress and spending efficiency.Rolling-Wave Forecast

This approach extends current burn rates (how quickly you're spending money on specific cost codes) over upcoming periods. It's useful for short to medium-term projections, especially for activities with consistent expenditure patterns.Sensitivity Analysis

What if material prices jump by 15%? Or a key piece of equipment breaks down, leading to a week's delay? Sensitivity analysis lets you model the impact of changes in key variables on your project's bottom line. You can explore best-case, worst-case, and most-likely scenarios. Example (US): A Florida-based contractor building a coastal resort uses sensitivity analysis in Archdesk to model the potential impact of a 10% increase in lumber prices due to tariff changes. The system quickly calculates the potential hit to their margins, allowing them to explore alternative suppliers or discuss a variation with the client.Monte Carlo Simulation

This more advanced technique runs thousands of "what-if" scenarios by randomly varying multiple project inputs (like labor productivity, material costs, weather delays) based on probability distributions. The output gives you a range of possible project outcomes and the likelihood of each, helping you understand risk exposure. Example (UK): A civil engineering firm in Manchester undertaking a complex bridge repair uses Monte Carlo simulations to assess the combined risk of potential delays due to unseasonal weather and fluctuating steel prices. Archdesk can help run these simulations, providing a P50 (50% probability of being at or below this cost) and P90 (90% probability) cost forecast, aiding in contingency planning.Milestone-Based Forecast

This ties financial projections and cash flow to the achievement of major project milestones (e.g., foundation complete, structure watertight, practical completion). It's particularly useful for aligning financial forecasts with the project schedule and client billing cycles.

The radar chart below illustrates how different forecasting methods might compare across key attributes important for construction FP&A. For instance, 'Real-time Adaptability' refers to how quickly the forecast can update with new data, while 'Complexity of Setup' indicates the initial effort required.

By leveraging these methods within Archdesk, construction CFOs can move from reactive damage control to proactive financial strategy.

Measuring What Matters: Earned Value Management (EVM) in Archdesk

Are You Getting Value for Your Money?

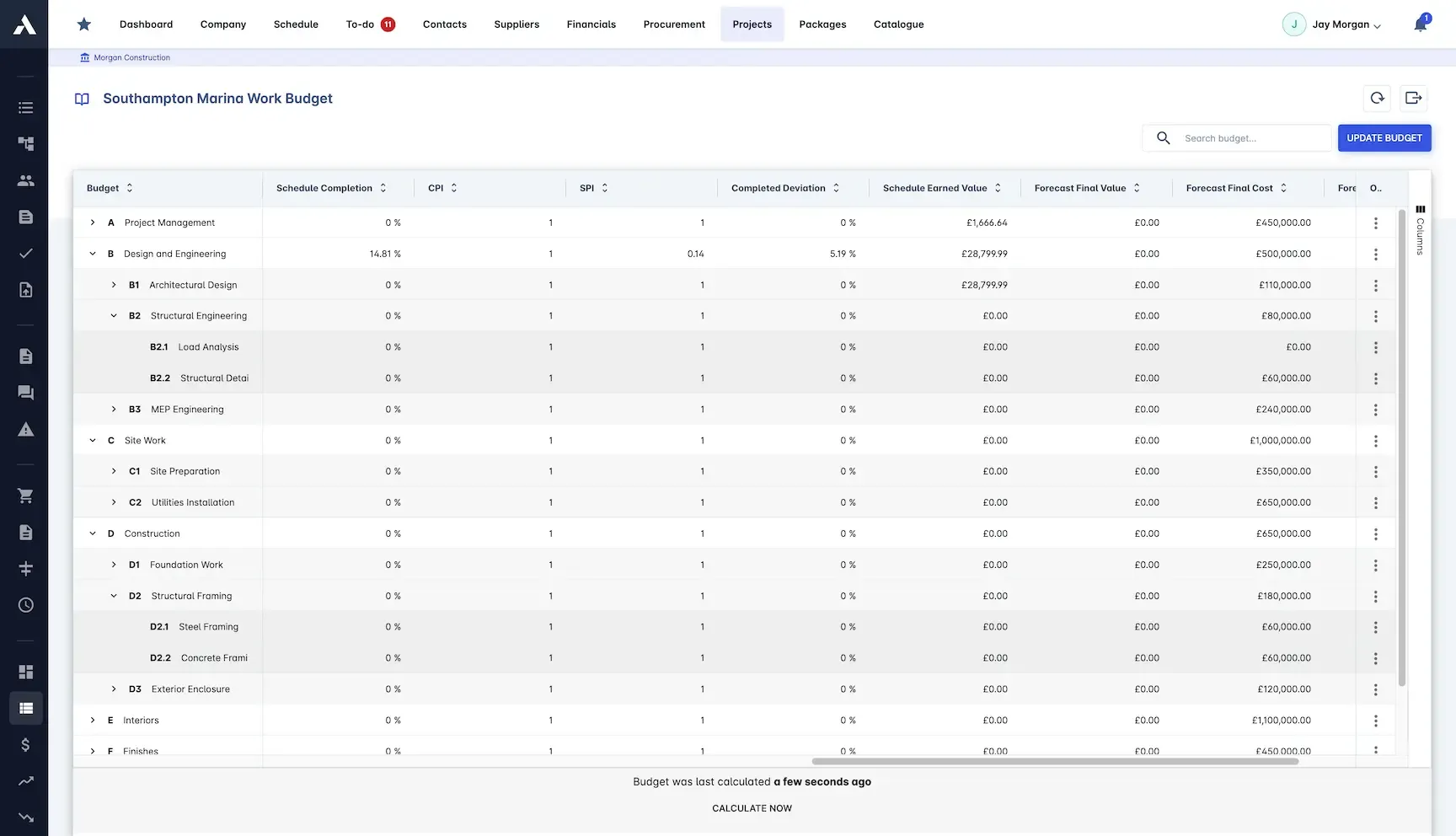

Earned Value Management (EVM) is a powerful technique to objectively measure project performance. It integrates scope, schedule, and cost to provide a snapshot of how your project is truly doing. Archdesk can provide the data needed to calculate and report on key EVM metrics.

Core EVM Metrics Explained:

- Planned Value (PV) or Budgeted Cost of Work Scheduled (BCWS): The authorized budget assigned to the work scheduled to be accomplished by a specific date. "What did we plan to spend by now?"

- Earned Value (EV) or Budgeted Cost of Work Performed (BCWP): The value of the work actually completed to date, measured in budgeted pounds or dollars. "How much of the planned work have we actually finished, in terms of budget?"

- Actual Cost (AC) or Actual Cost of Work Performed (ACWP): The total cost actually incurred and recorded in accomplishing the work performed by a specific date. "What have we actually spent so far?"

From these, we derive critical performance indicators:

- Cost Variance (CV): EV - AC. A positive CV is good (under budget); a negative CV is bad (over budget).

- Schedule Variance (SV): EV - PV. A positive SV is good (ahead of schedule); a negative SV is bad (behind schedule).

- Cost Performance Index (CPI): EV / AC. A CPI greater than 1 means you're getting more value than you're spending; less than 1 means you're over budget for the work done.

- Schedule Performance Index (SPI): EV / PV. An SPI greater than 1 means you're ahead of schedule; less than 1 means you're behind.

- Estimate at Completion (EAC): A forecast of the most likely total project cost. A common formula is AC + (BAC - EV) / CPI, where BAC is Budget at Completion.

Example (US): A Denver-based contractor is building a new school. At month 6: PV = $500,000 (Planned to complete $500k worth of work) EV = $450,000 (Actually completed $450k worth of work) AC = $480,000 (Actually spent $480k) Calculations: CV = $450k - $480k = -$30k (Over budget) SV = $450k - $500k = -$50k (Behind schedule) CPI = $450k / $480k = 0.9375 (For every dollar spent, getting 93.75 cents of value) SPI = $450k / $500k = 0.90 (Only 90% of planned work completed) Archdesk, by tracking actual costs and progress against the plan, would highlight these variances, prompting the project manager to investigate the causes for the overspend and delay.

Example (UK): An Edinburgh-based firm constructing a retail park finds their SPI is 1.1 (ahead of schedule) but CPI is 0.9 (over budget). Archdesk's detailed cost breakdown allows them to see that while progress is good, overtime costs for one trade package are driving up expenses. This allows for targeted intervention.

Keeping Tabs on Progress: WIP and Cash Flow Management

From Work Done to Money in the Bank

Understanding your Work-In-Progress (WIP) and managing cash flow are critical for any construction business's survival and growth. Archdesk facilitates this by connecting project delivery to your financials.

Work-In-Progress (WIP) Reporting

WIP reports are essential for accurately recognizing revenue and costs on ongoing projects. They help you understand:

- Accruals: Costs incurred or revenue earned for work completed but not yet invoiced or paid. For example, your team completed a phase of work at the end of the month, but the application for payment will only go out next month. Archdesk helps you account for this earned (but not yet billed) revenue.

- Prepayments (or Deferred Revenue): Cash received from a client for work that hasn't started or been completed yet. This is a liability until the work is done.

Archdesk helps generate WIP schedules that typically show contract value, costs to date, percentage complete, amount billed, and earned revenue, highlighting any over/under billings. This is crucial for accurate financial statements and maintaining bonding capacity.

Example (US): LA Constructors, working on a highway expansion, uses Archdesk's WIP reporting. It shows $1.2M in earned revenue based on progress, but they've only billed $1M. The $200k difference is accrued revenue, giving a truer picture of their financial position than just looking at cash received.

Example of a dashboard for tracking construction project costs.

Applications for Payment and Cash Flow

Based on the original scope of work, progress updates, and any approved variations, Archdesk allows you to generate accurate applications for payment to your client. Once these are approved and payment is received, the system tracks this income. This means you can report not just on revenues (accrual basis) but also on actual cash flow.

Understanding your cash inflows (client payments) and outflows (supplier payments, labor costs, overheads) is paramount. Archdesk provides tools to monitor your cash position, forecast future cash flows based on payment schedules and expected expenses, helping you avoid liquidity crunches.

Example (UK): A developer in Cardiff constructing an apartment complex uses Archdesk to track incoming stage payments from buyers against outgoing payments to subcontractors. The cash flow forecast in Archdesk highlights a potential shortfall in three months if a major client payment is delayed, allowing them to arrange a short-term credit line proactively.

The Archdesk Advantage: Why It Leads the Pack for Construction FP&A

A System Built for Construction Realities

Many software solutions claim to handle construction finance, but Archdesk stands out because it's built from the ground up with construction workflows in mind. It's not a generic accounting package with a few construction modules bolted on. The entire system, from project initiation to final account, is integrated and designed to provide real-time financial intelligence.

This mindmap illustrates the core strengths that make Archdesk a powerful FP&A tool for construction CFOs:

The key differentiator is this tight integration. Labor hours logged on site, materials procured, subcontractor valuations approved – all these operational activities feed directly and immediately into the financial picture, all linked through the central cost coding structure. This eliminates data silos and the errors that come from manual data re-entry between different systems.

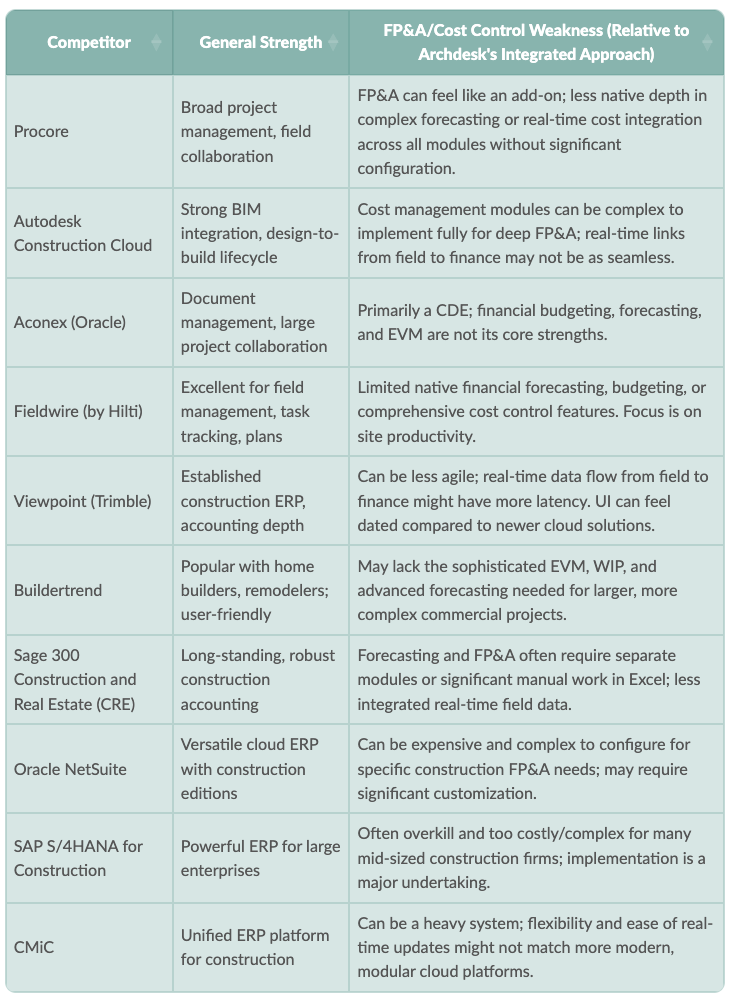

Sizing Up the Competition

How Archdesk Compares

While Archdesk offers a robust, construction-specific FP&A solution, it's important to know the landscape. Here’s a look at some other players in the construction accounting and forecasting space. This isn't about bashing competitors, but about highlighting where Archdesk's focus on integrated, real-time financial control for complex projects gives it an edge.

The main difference often boils down to Archdesk's project-first architecture where financials are intrinsically linked to project operations from day one, providing that crucial real-time visibility without the need for extensive integrations or clunky workarounds that some broader ERPs or point solutions might necessitate.

Frequently Asked Questions (FAQ)

How quickly can we get Archdesk up and running for our projects?

Implementation time varies depending on the complexity of your existing processes and data. However, Archdesk is designed for relatively rapid deployment compared to traditional ERPs. The focus on project setup, BoQ, and cost codes means you can start seeing benefits on new projects fairly quickly. Many firms report getting initial projects budgeted and tracked within weeks, not months.

Does Archdesk integrate with our existing accounting software?

Yes, Archdesk is designed to integrate with popular accounting systems. This allows you to maintain your corporate accounting system of record while using Archdesk for detailed project financial control, forecasting, and operational management. The aim is to provide seamless data flow, not replace your entire financial infrastructure unless desired.

Is Archdesk suitable for smaller construction companies, or just large enterprises?

Archdesk is scalable and used by a range of construction companies, from medium-sized businesses to larger enterprises. Its modular nature and cloud-based delivery make it accessible. The key is whether your projects have a degree of complexity in budgeting, cost control, and forecasting that would benefit from a dedicated, integrated system. Archdesk also offers 'Archdesk Essentials' tailored for smaller contractors.

How does Archdesk handle project variations and change orders financially?

Archdesk has robust processes for managing variations and change orders. Approved changes can update the project BoQ, budget, and scope directly within the system. This ensures that your financial forecasts and reports always reflect the current, approved project parameters, preventing scope creep from silently eroding profits.