Key Takeaways for Construction Leaders

- Traditional metrics like revenue and profit are insufficient: While essential, they don't provide the full picture of cash flow or impending financial issues, often masking underlying problems like tied-up capital or slow payments.

- Focus on nuanced financial KPIs: Metrics such as Backlog-to-Working-Capital Ratio, Days Sales Outstanding (DSO), and Worker-Hour-to-Revenue Ratio are vital for proactive cash flow management and early detection of financial distress.

- Integrated software is a game-changer: Leveraging construction management software like Archdesk centralizes data, automates tracking, and provides real-time dashboards, transforming how CEOs monitor and act on financial health indicators.

For construction CEOs, the typical view of success often hinges on two big numbers: revenue and profit. And yes, those are important for celebrating wins. But imagine driving a large construction vehicle by only looking at the speedometer and fuel gauge. You might know your speed and how much gas you have, but you're missing the potholes, the sharp turns, or the sudden stops ahead. In the dynamic world of construction, relying solely on revenue and profit is a bit like that – it tells you what happened, but rarely why, or what's coming next.

The construction industry is a complex machine with unique financial rhythms. Payments can be slow, material costs can jump unexpectedly, and project timelines can stretch. These realities mean cash flow is king, and any disruption can quickly lead to major headaches. To truly navigate this environment, smart leaders are turning their attention to more specific, forward-looking financial Key Performance Indicators (KPIs).

These aren't just fancy terms; they are the vital signs of your business, giving you early warnings about potential financial issues before they become critical. By tracking these focused metrics, construction companies can pinpoint areas needing adjustment, improve efficiency, and make clear, data-driven decisions that lead to greater profitability and long-term success. You simply cannot improve what you do not measure, and in construction, guessing is a risky business.

Why Revenue and Profit Tell Only Half the Story

The Hidden Gaps in Traditional Financial Reporting

Think about it: Your company could be booking high-value projects and showing impressive revenue growth, yet still struggle to pay subcontractors on time. Or, your profit margins might look healthy on paper, but a significant portion of that profit is tied up in accounts receivable that haven't been collected in months. This is the classic "cash flow crunch" – a situation where profitability doesn't equal liquidity.

These issues highlight why simply looking at revenue and profit can be misleading. They are historical metrics, telling you about past performance. What CEOs truly need are predictive indicators that offer insights into future cash position and potential financial distress. Ignoring these can lead to unexpected challenges, forcing companies to rely on credit lines or even personal savings to cover operating expenses, which affects everything from material procurement to staff morale.

The Cash Flow Imperative in Construction

Construction projects often involve substantial upfront costs for materials and labor, with client payments usually following a progress-based billing cycle. This means there's a constant ebb and flow of cash, and managing this flow is paramount. High revenue numbers are great, but if the cash isn't actually flowing into your bank account, you're building on shaky ground. That's where specific financial KPIs become your best friends, offering clarity, fostering operational improvements, and ensuring financial stability.

Essential Financial KPIs Beyond the Basics

Metrics That Drive Smarter Decisions and Predict Challenges

While fundamental metrics like net income and gross profit margin are foundational, construction companies must look deeper. Let’s explore the more advanced financial KPIs that every construction CEO should be paying close attention to.

1. Backlog-to-Working-Capital Ratio: Your Financial Runway Indicator

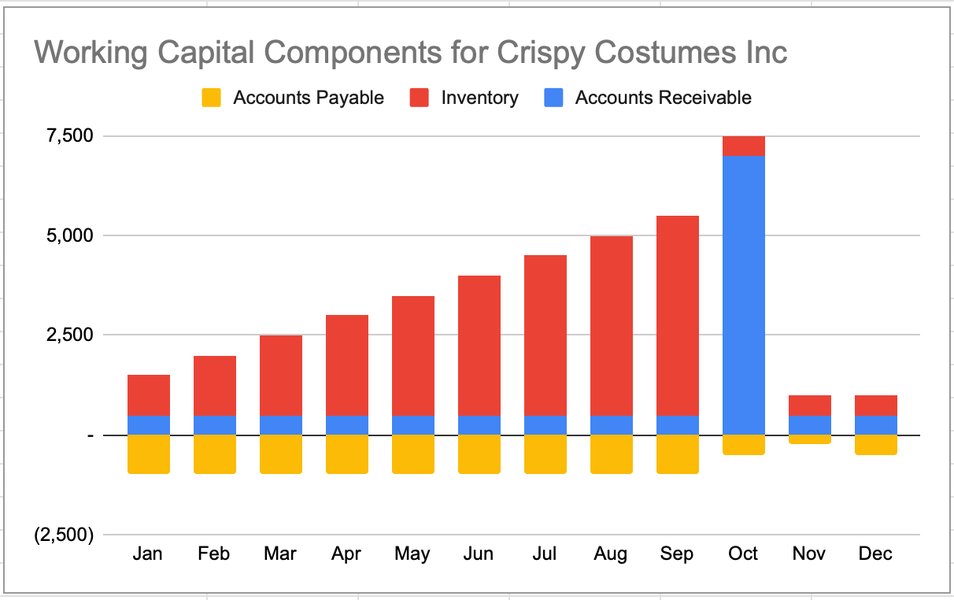

This KPI is a powerful indicator of your company's capacity to take on new projects without straining its financial resources. It compares your total contracted but uncompleted work (your "backlog") against your "working capital," which is the money available for daily operations (current assets minus current liabilities).

Why it matters: A healthy backlog is a positive sign of future work, but an excessively large backlog relative to your working capital is a red flag. It means you might be overbooked and lack the liquid funds to cover the upfront costs for these future projects. Conversely, a low ratio might signal a lack of future work. For example, a ratio above 3:1 can indicate you're overextended, needing to pause bidding or secure additional financing. A ratio below 1:1 suggests you're underbooked and need to ramp up sales efforts. Maintaining a balance, often between 1.5:1 and 3:1, is crucial for long-term success and smooth cash flow.

This ratio helps forecast future earnings and resource allocation, ensuring you have enough capital to perform the contracted work. If your backlog is $10 million and working capital is $2 million, your ratio is 5:1 – a clear sign to reconsider aggressive bidding until your working capital improves.

2. Days Sales Outstanding (DSO): The Cash Flow Speedometer

DSO measures the average number of days it takes for your company to collect payment after a sale or completion of a billing milestone. In construction, where payment cycles can be extended, monitoring DSO is particularly important.

Why it matters: High DSO means your money is tied up in accounts receivable, directly impacting your cash flow. If clients are taking 60, 70, or even 90 days to pay, you're essentially acting as their bank, covering project expenses with your own funds. The industry average for DSO is around 45 days. If you're consistently above 60 days, you are facing significant liquidity challenges. Delayed payments can lead to a loss of purchasing power due to inflation, interest expenses from borrowing, and missed growth opportunities.

Effective accounts receivable management, including clear payment terms, progress billing, and automated invoicing, is vital for improving cash flow and protecting profitability. Some companies offer small discounts (e.g., 2% for 15-day payment) to encourage faster collections, while others might adjust payment terms for clients who consistently delay payments.

The ripple effect of high DSO extends throughout your entire construction operation.

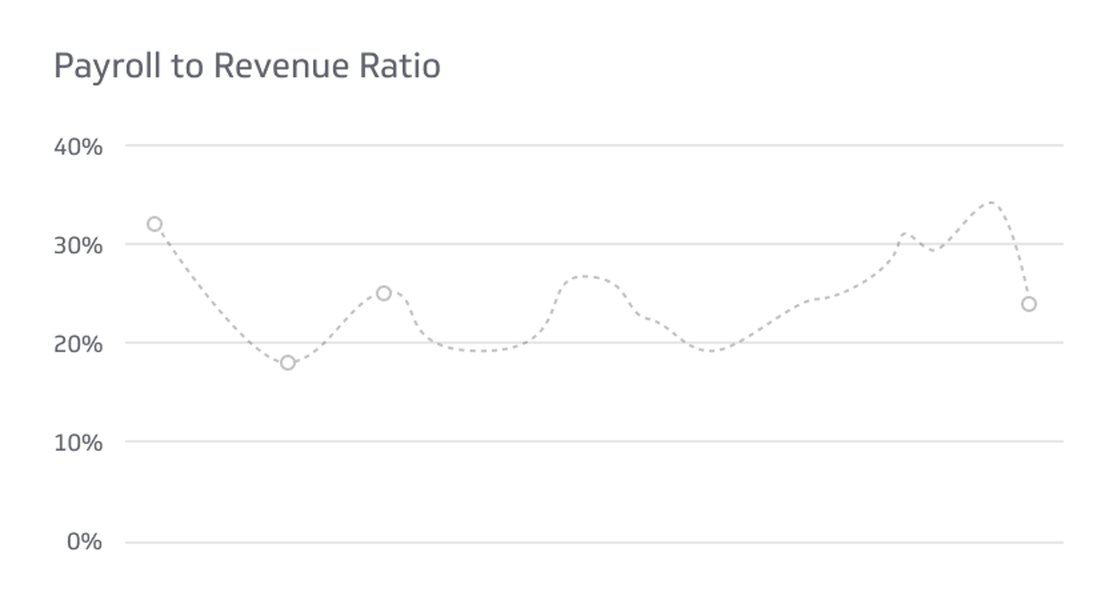

3. Worker-Hour-to-Revenue Ratio: Measuring Labor Productivity

This KPI measures the efficiency of your workforce by comparing total labor hours expended to the revenue generated over the same period. It helps standardize labor productivity across different projects and seasons.

Why it matters: Labor costs are a significant portion of any construction project's expenses. A rising worker-hour-to-revenue ratio without a corresponding increase in revenue indicates a decline in labor productivity, which can quickly eat into profit margins. For instance, a 10% increase in labor hours without revenue growth can slash net margins by 3-5%.

By tracking this ratio per project or per trade, you can identify inefficiencies. If your electrical work crews are hitting 0.08 hours per dollar of revenue, but your plumbing crews are at 0.12, you have a productivity leak to investigate. Industry benchmarks often suggest a solid range is between 0.05 and 0.07 hours per dollar of revenue, depending on the trade.

Visualizing your payroll-to-revenue trend can highlight changes in labor efficiency.

Beyond the Core Three: Other Vital KPIs for a Holistic View

While the three KPIs above are often overlooked yet critical, many other financial and operational KPIs offer a comprehensive view of a construction company's health.

Cost Performance Index (CPI) and Schedule Performance Index (SPI)

- CPI (Earned Value / Actual Cost): Shows how efficiently you've used the project budget. A CPI under 1.0 means cost overruns; above 1.0 means under budget.

- SPI (Earned Value / Planned Value): Measures time efficiency. An SPI under 1.0 indicates project delays; above 1.0 means you're ahead of schedule. Both are crucial for maintaining cash flow and preventing future financial distress.

Current Ratio and Operating Cash Flow Ratio

- Current Ratio (Current Assets / Current Liabilities): A quick check on your ability to meet short-term obligations. A ratio of 1.2 or higher is generally good, as construction requires high liquidity.

- Operating Cash Flow Ratio (Cash Flow from Operations / Current Liabilities): Measures your ability to cover debts solely from your core business operations. A declining ratio below 0.5 can signal future financial issues.

Gross Profit Margin and Work-in-Progress (WIP) Analysis

- Gross Profit Margin ((Revenue - Cost of Sale}) / Revenue): Still a core metric, it indicates the percentage of revenue remaining after direct project costs. It reflects your ability to generate profit from contracts.

- WIP Report (Over/Under Billings): The WIP report is a crucial financial tool. Overbillings occur when you've billed more than the earned revenue, potentially boosting cash flow but also creating a future liability. Underbillings mean earned revenue is higher than the billed amount, representing completed work not yet invoiced. Understanding these helps manage cash flow and improve profit margins.

Other Key Operational Indicators with Financial Impact

- Safety Incident Rate: Fewer incidents mean fewer injury-related costs, lower insurance premiums, and avoided legal problems.

- Equipment ROI ((Revenue from Equipment - Maintenance Costs) / Equipment Cost): Crucial for fleet management. If ROI is consistently under 1.2, it might be time to sell or replace equipment.

- Change Order Velocity: The time it takes to approve change orders. Delays here can significantly increase project costs and extend your DSO.

- Client Satisfaction: While not directly financial, high client satisfaction often leads to repeat business and positive referrals, directly impacting future revenue and profitability.

Predicting Distress: How KPIs Act as Early Warning Systems

Spotting Financial Problems Before They Escalate

The true power of these KPIs lies in their ability to signal trouble before it becomes a crisis. Imagine them as a dashboard of sensors for your company's financial health. If you see your backlog-to-working-capital ratio steadily climbing above healthy benchmarks (e.g., beyond 4.0), while your DSO simultaneously creeps up (e.g., over 70 days), and your operating cash flow ratio declines below 0.5, you're looking at a clear forecast for a cash crunch.

A mid-sized contractor, Riverside Builders, once found itself in this exact situation. Their profits looked good, but their backlog-to-capital ratio hit 4:1, and DSO soared to 68 days. By tracking these KPIs, they identified two overstaffed projects (high worker-hour ratio) and renegotiated terms with slow-paying clients. They also secured a line of credit based on software-generated KPI forecasts. The result: their margins improved from 3% to 7% in six months, averting a major financial crisis.

Leveraging Integrated Software for KPI Mastery

From Spreadsheets to Real-Time Dashboards

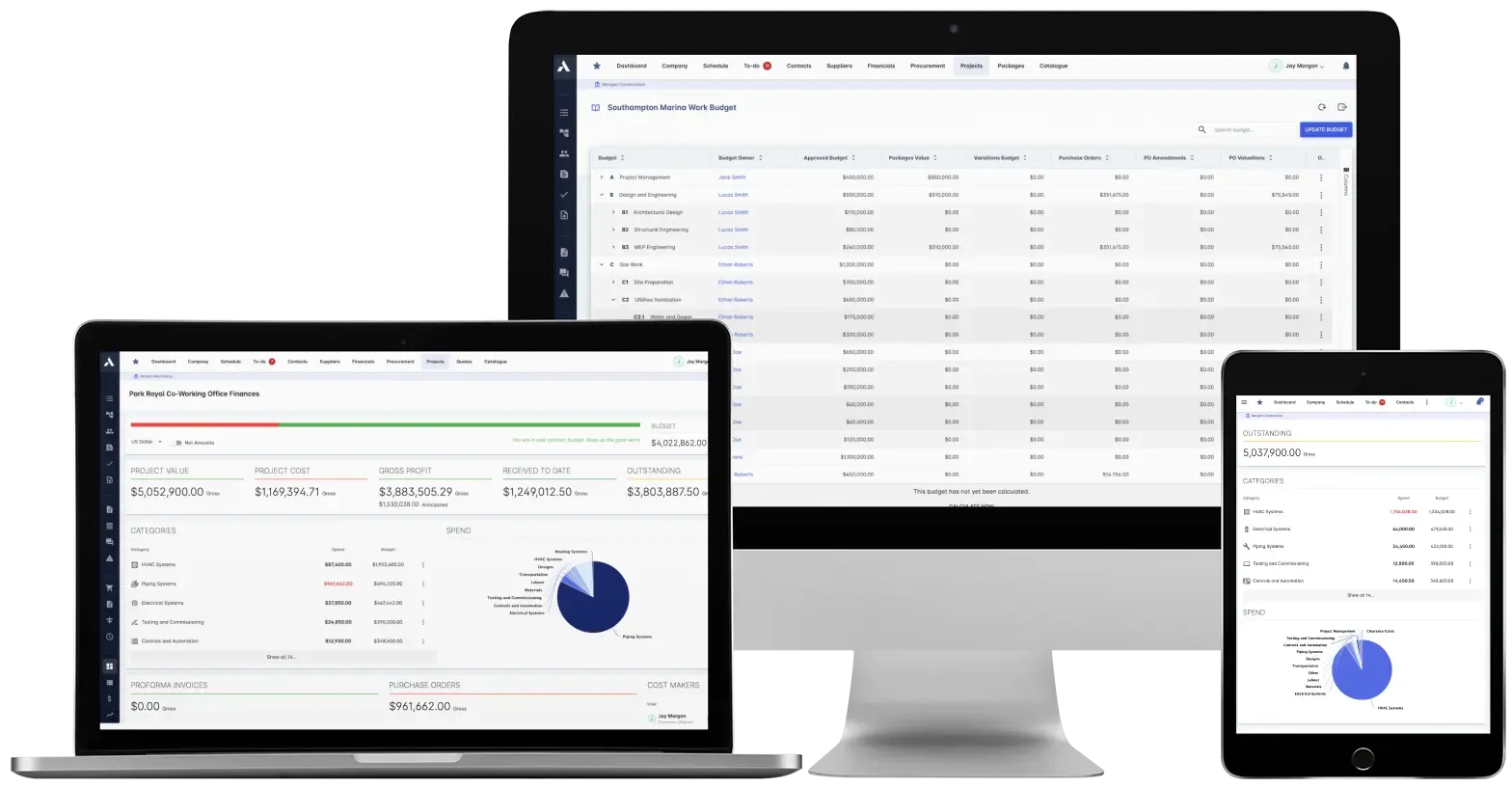

Trying to track all these KPIs manually with spreadsheets is a recipe for errors and delays. It's like trying to manage a construction site with only clipboards and paper plans. This is where integrated construction management software steps in as a game-changer.

Platforms like Archdesk are designed to centralize project and financial data, offering real-time visibility into your operations. Instead of waiting for month-end reports, you get live dashboards that allow you to visualize key metrics, drill down into underlying data, and make informed decisions on the fly. This capability is what transforms financial planning and analysis from a spreadsheet nightmare into a controlled process.

A comprehensive KPI dashboard provides an at-a-glance view of your company's health.

How Integrated Software Transforms KPI Tracking

- Centralized Data: All project-related and financial data is consolidated, eliminating fragmented tools and spreadsheets. This centralization is key for enhanced project and financial management.

- Automated Data Collection: Many construction tech solutions can gather and evaluate KPIs automatically, ensuring data accuracy and consistency, rather than manual input which is prone to human error.

- Customizable Dashboards: While there are common KPIs, every company has unique needs. Software allows you to tailor predefined KPIs to fit your specific business situation, creating a control tower for your business.

- Predictive Analytics: Beyond historical measurements, modern software can use current data (like bid data and payment trends) to project cash flow, resource utilization, and future project progress.

Compared to older or less integrated solutions, Archdesk bundles project controls, finance, procurement, and reporting into a single platform. This reduces administrative hours each month and gives CEOs a unified, real-time view of their business.

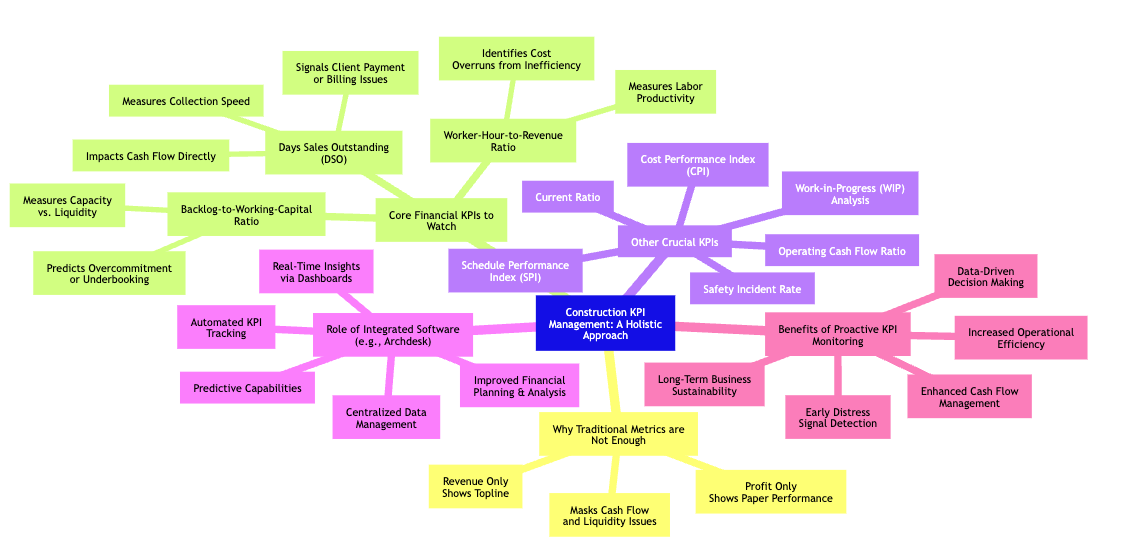

This mindmap illustrates a holistic approach to construction KPI management, showing why traditional metrics are insufficient, outlining core and other crucial KPIs, and emphasizing the role of integrated software in achieving benefits like enhanced cash flow and early distress detection.

Real-World Impact: Companies Using Advanced KPI Tracking

Companies using integrated tools report substantial improvements. For instance, some firms have reduced their DSO by 20-30% by adopting automated invoicing and better collection strategies, directly impacting their cash flow. On the labor front, businesses that meticulously track their worker-hour-to-revenue ratio have boosted efficiency by optimizing staffing and identifying underperforming areas, leading to significant cost savings.

The transition from manual tracking to integrated systems means faster crisis response times – up to 30% quicker for companies using advanced tools compared to those relying on spreadsheets or less integrated platforms.

A Practical Approach to Implementing KPI Tracking

Your Action Plan for Better Financial Health

Starting with KPI tracking doesn't have to be overwhelming. Here's a straightforward action plan:

- Define Your Targets: Begin by selecting three core KPIs that are most critical for your business (e.g., Backlog-to-Working-Capital Ratio, DSO, Worker-Hour-to-Revenue Ratio). Set realistic targets for each.

- Configure Your Software: Work with your IT team or software provider (like Archdesk) to configure your system to track these specific KPIs automatically. Ensure data points from project management, accounting, and payroll modules are linked.

- Train Your Teams: Standardize data entry and reporting processes across your project and finance teams. Everyone needs to understand the importance of accurate data for effective KPI analysis.

- Review Regularly: Make KPI review a consistent part of your leadership meetings. Address exceptions and anomalies promptly. Weekly or bi-weekly huddles can be highly effective.

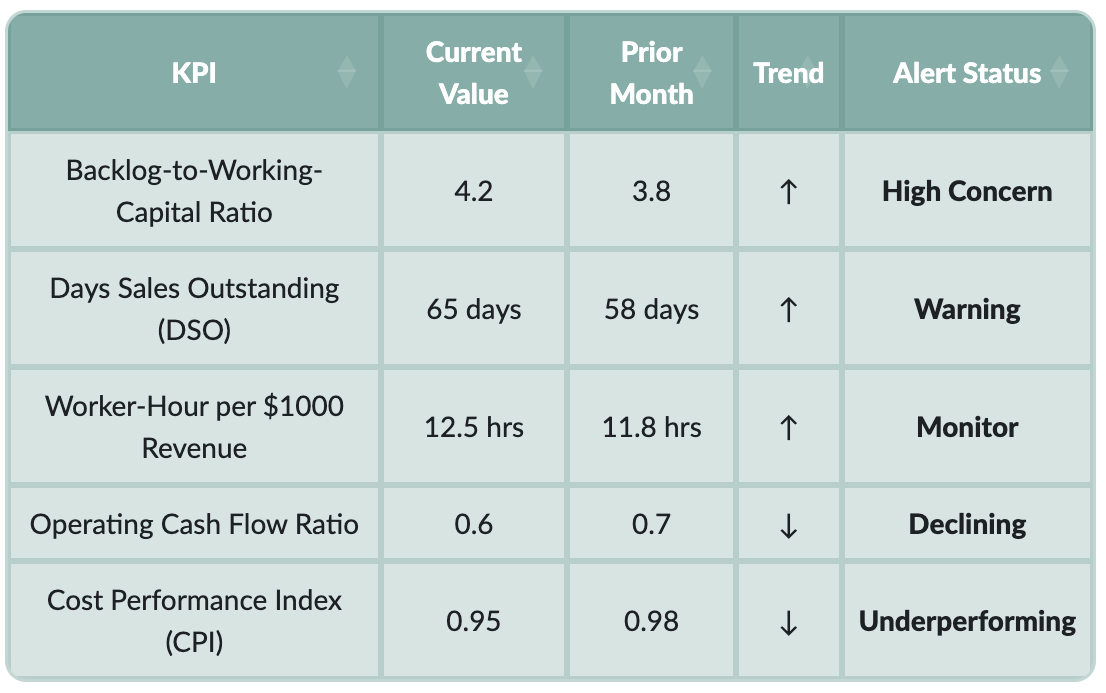

A simple dashboard or table can provide a quick glance at your company's financial pulse:

This table provides a snapshot of key financial KPIs, showing current values, trends, and immediate alert statuses to guide CEO attention.

Frequently Asked Questions (FAQ)

What's the biggest risk of ignoring these financial KPIs?

The biggest risk is encountering a severe cash flow crunch that could threaten your company's operations or even survival, despite appearing profitable on paper. Without these KPIs, you lack early warning signals for financial distress.

How often should a CEO review these KPIs?

While some operational KPIs can be reviewed weekly by project managers, a CEO should ideally review the core financial KPIs (Backlog-to-Working-Capital, DSO, Worker-Hour-to-Revenue, Cash Flow, etc.) at least monthly, and ideally weekly for significant trends or anomalies, especially during periods of rapid growth or economic uncertainty.

Can smaller construction companies benefit from tracking these advanced KPIs?

Absolutely. While large enterprises have complex systems, the principles apply to businesses of all sizes. Even smaller companies can adapt these KPIs to their scale, often benefiting even more due to tighter margins and less financial cushion. Integrated software can make this process accessible and manageable.

What's the difference between 'revenue' and 'cash flow'?

Revenue is the total income a company generates from its sales activities over a period, regardless of whether the cash has been collected. Cash flow is the actual movement of money into and out of the business. You can have high revenue but poor cash flow if clients are slow to pay or if you have large outstanding expenses.

Conclusion

For construction CEOs, relying solely on revenue and net profit figures is akin to steering a ship with only a compass and no map or depth sounder. The complexities of project financing, long payment cycles, and variable costs demand a deeper, more nuanced understanding of financial health. By embracing KPIs like the Backlog-to-Working-Capital Ratio, Days Sales Outstanding, and Worker-Hour-to-Revenue Ratio, leaders gain a powerful set of tools to proactively manage cash flow and detect potential financial distress before it becomes a crisis.

Integrated construction management software, exemplified by platforms like Archdesk, is no longer a luxury but a necessity. It automates data collection, provides real-time insights through intuitive dashboards, and empowers CEOs to make swift, data-driven decisions. In today's dynamic construction landscape, characterized by labor shortages and fluctuating material costs, tracking and analyzing these vital financial signs is not just smart business—it's essential for survival, sustainable growth, and building a resilient future.

References

Archdesk Case Studies: City Diamond Contracting - Archdesk

4 leading measures contractors can use to evaluate operations - RSM

10 Most Important KPIs for Construction Companies - Bluevine

Check your construction company’s vital signs with KPIs - Jones & Roth CPAs & Business Advisors

Key Performance Indicators: Navigating Success in the Construction Industry - Grassi Advisors