Key Highlights

- Upcoming Regulatory Shifts: Stay ahead of changes like the March 2025 CIS update (including traffic management) and the 2026 UK GAAP overhaul (FRS 102) impacting revenue recognition.

- Integrated Financial Management: Discover how linking project management software (like Archdesk) with accounting systems creates a powerful, unified view of project financials, essential for accuracy and compliance.

- Proactive Financial Practices: Learn best practices for revenue recognition, cost coding, forecasting, and managing retentions to ensure robust financial health and avoid costly errors.

Laying the Foundation: Understanding UK GAAP in Construction

The Rulebook for Reliable Reporting

Think of UK Generally Accepted Accounting Practice (UK GAAP) as the essential blueprint for your company's financial statements. Mandated by the Financial Reporting Council (FRC) and the Companies Act 2006, it ensures your accounts are consistent, comparable, and give a true picture of your financial health. For most mid-sized construction firms, the key standard is FRS 102.

Core UK GAAP Principles for Construction:

- Accrual Accounting: Recognise income and costs when they're earned or incurred, not just when cash changes hands. This is vital for understanding profitability on long projects.

- Consistency: Apply the same accounting policies year after year. Switching methods without good reason makes comparisons difficult and might raise eyebrows with auditors or HMRC.

- Prudence (or Caution): Don't overstate assets or income, and don't understate liabilities or expenses. Better safe than sorry!

- Going Concern: Assume the business will continue operating for the foreseeable future unless there's significant evidence otherwise.

Upcoming GAAP Overhaul (Effective Jan 1, 2026)

Get ready! The FRC issued significant updates to UK GAAP (mainly FRS 102) in March 2024, effective for accounting periods starting on or after 1 January 2026. Early adoption is possible, but it's an 'all-or-nothing' deal.

Key changes affecting construction include:

- Revenue Recognition: Moving closer to the IFRS 15 model, focusing on 'performance obligations' and the transfer of control to the customer. This might mean recognising revenue later for contracts involving significant services alongside construction. (More on this later!)

- Lease Accounting: Major changes are coming for how leases are treated on the balance sheet, potentially bringing more lease liabilities into view.

Tip: Start reviewing your contracts now. Understand how the new revenue rules might impact profit recognition timing and begin adapting your systems and processes. Don't wait until the last minute!

Good GAAP Practices:

- Meticulous Bookkeeping: Every transaction, receipt, and invoice needs accurate logging. It’s the bedrock of reliable accounts.

- Prepare Core Statements: Regularly generate Balance Sheets, Income Statements (P&L), and Cash Flow Statements. These are your financial dashboards.

- Seek Expertise: Construction accounting has unique complexities. A specialist accountant can be invaluable.

Understanding UK GAAP fundamentals is crucial for compliance.

Decoding the Construction Industry Scheme (CIS)

Keeping HMRC Happy and Cash Flowing

The Construction Industry Scheme (CIS) is a specific tax deduction system for the UK construction sector. It's designed to minimise tax evasion by ensuring tax is collected at source from payments made by contractors to subcontractors.

How CIS Works:

- Contractors: Deduct tax from payments made to subcontractors for construction work.

- Subcontractors: Have tax deducted from their payments, which counts as an advance payment towards their overall tax and National Insurance liability.

- Deduction Rates:

- 20%: For subcontractors registered with CIS.

- 30%: For subcontractors not registered with CIS.

- 0% (Gross Payment Status): For subcontractors who meet specific HMRC criteria (turnover, compliance history, etc.), allowing them to be paid in full without deductions.

Key CIS Responsibilities:

- Registration: Both contractors and subcontractors undertaking qualifying work must register with HMRC.

- Verification: Contractors must verify subcontractors with HMRC before paying them to determine the correct deduction rate.

- Deduction: Apply the correct rate to the labour element of the subcontractor's invoice (materials are typically excluded).

- Monthly Returns (CIS300): Contractors must file monthly returns detailing all payments made to subcontractors and deductions taken.

- Payment to HMRC: Pay the deducted amounts to HMRC monthly.

- Statements: Provide subcontractors with payment statements showing amounts paid and deductions made.

Crucial Update: CIS Expansion from March 2025

Big News! From 1 March 2025, the scope of CIS is expanding to include certain traffic management services directly related to construction operations. This means if you hire a firm for temporary traffic lights, barriers, road closures, or site access control as part of a construction project, you'll likely need to verify them and apply CIS deductions to their payments.

Example: You hire 'Safe Roads Ltd' for £5,000 to manage traffic during road resurfacing works. From March 2025, you must verify Safe Roads Ltd. If they are registered for CIS but don't have gross payment status, you'll deduct 20% (£1,000, assuming the whole £5k is labour) before paying them and report this on your CIS return.

Tip: Review your supplier list now. Identify any traffic management providers and ensure your processes are ready for this change to avoid penalties for incorrect processing.

CIS Compliance Tips & Tricks:

- Worker Status: Correctly classify individuals as employed vs. self-employed subcontractors. Misclassification is a major compliance risk. Use HMRC's tools if unsure.

- Record Keeping: Keep meticulous records of verifications, invoices, payment statements, and CIS returns for at least 3 years. HMRC loves a good paper trail!

- Scope Awareness: Be clear on what constitutes 'construction operations' under CIS. It's broader than just building work.

- Funny but True: Treating CIS verification like checking someone's ID before serving them a pint – skip it, and you could face a hefty penalty much worse than a hangover.

Getting CIS right involves understanding deductions, verification, and reporting.

Revenue Recognition: Timing is Everything

When Can You Actually Book That Income?

Recognising revenue accurately is critical in construction due to long project timelines. Getting it wrong can distort your financial performance and lead to compliance issues. FRS 102 (Section 23) currently guides this, but remember those 2026 changes!

Common Methods (Current & Evolving):

- Percentage of Completion (PoC): Recognise revenue and costs based on the project's stage of completion. This is often measured by the proportion of costs incurred to date compared to total estimated costs. Requires reliable estimates.

Example: Contract value £1M, estimated total cost £800k. If you've incurred £200k costs (25% of total), you recognise 25% of the revenue (£250k). - Completed Contract: Recognise all revenue and costs only when the project is fully completed. Simpler, but leads to lumpy profit reporting. Generally used only when outcomes cannot be reliably estimated.

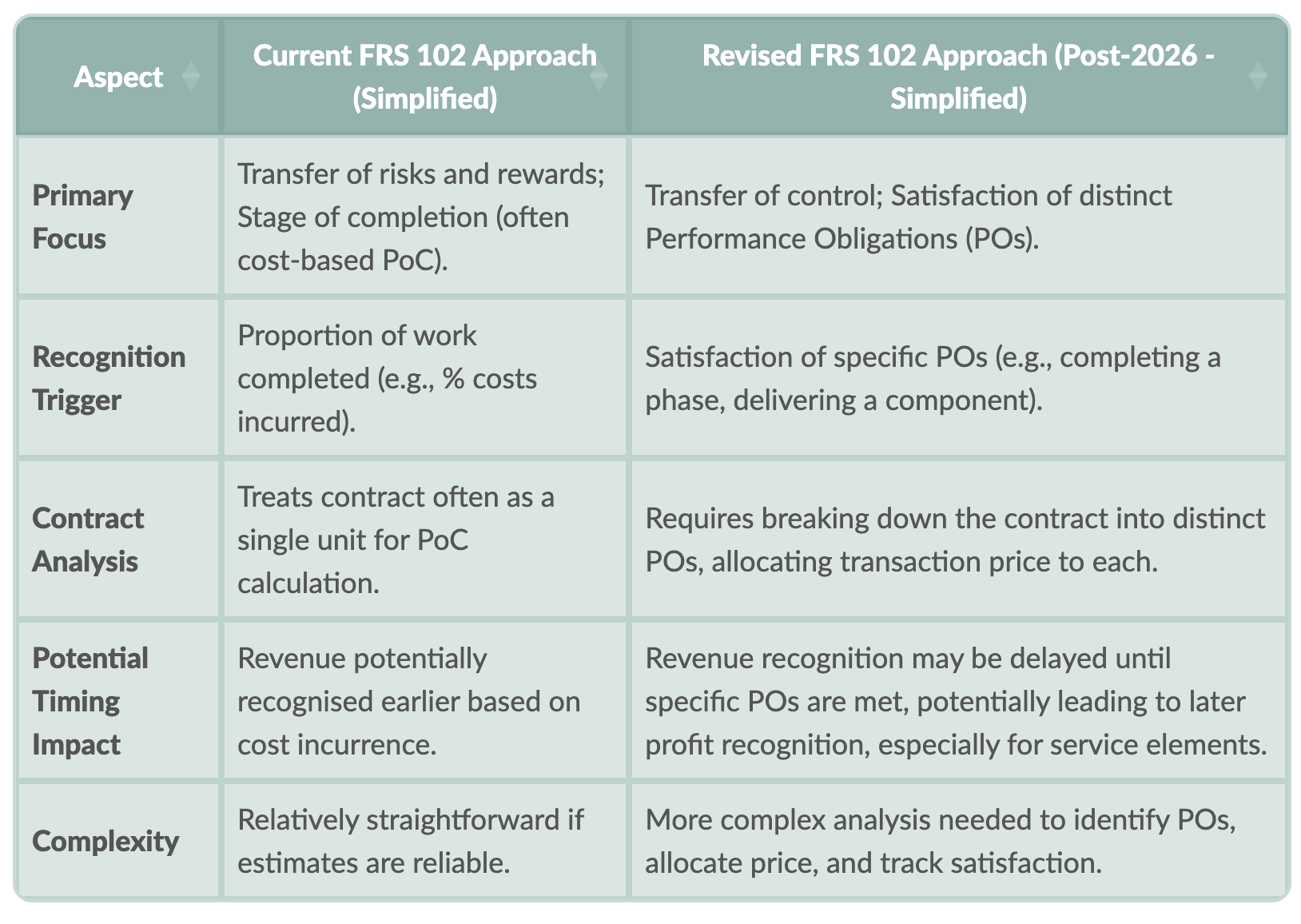

The Shift Towards Performance Obligations (Post-2026 GAAP)

The upcoming FRS 102 changes align more closely with IFRS 15. This means shifting focus from 'risks and rewards' transfer to identifying distinct 'performance obligations' (promises to deliver goods or services) within a contract. Revenue is recognised as each obligation is satisfied.

Impact: For contracts with multiple deliverables (e.g., design, build, maintain), revenue might be allocated and recognised at different points. For service-heavy contracts, this could delay profit recognition compared to the current PoC method based purely on costs incurred. You'll need robust systems to track the satisfaction of these obligations.

Revenue Recognition Best Practices:

- Robust Estimating: Accurate PoC depends on reliable estimates of total project costs and progress. Regularly review and update these estimates.

- Contract Review: Understand the specific terms of each contract, especially regarding deliverables and payment milestones.

- Documentation: Keep clear records supporting the basis for revenue recognition (e.g., surveyor reports, cost schedules, client sign-offs).

Comparison of Revenue Recognition Approaches (Pre- & Post-2026 FRS 102 Changes)

The following table illustrates the conceptual shift in recognizing revenue for construction contracts under the upcoming UK GAAP changes.

Forecasting, Cost Coding & General Ledger: The Financial Engine Room

Building Financial Clarity from the Ground Up

Accurate forecasting, detailed cost tracking, and a well-organised general ledger (GL) are vital for managing cash flow, controlling costs, and making informed decisions in the volatile construction sector.

Forecasting & Budgeting: Your Financial Crystal Ball

- Project-Level Detail: Budgets and forecasts need to be granular, tracking estimated vs. actual costs for labour, materials, subcontractors, plant hire, and overheads for each job.

- Regular Reviews: Projects evolve. Update forecasts frequently based on actual progress, change orders, and unforeseen issues. A static forecast is a useless forecast!

- Cash Flow is King: Construction often involves paying out significant sums before client payments arrive. Accurate cash flow forecasting is non-negotiable to manage liquidity and secure funding. Include CIS deductions and retentions.

- Scenario Planning: What if materials jump 10%? What if a key project is delayed? Model different scenarios to understand potential impacts.

Cost Coding: Knowing Where Every Penny Goes

Cost coding involves assigning unique codes to different types of expenditure within specific projects. This allows for detailed tracking and analysis.

Example structure for cost coding, enabling detailed expense tracking by project and type.

- Benefits:

- Profitability Analysis: Pinpoint which activities or phases are over/under budget.

- Accurate Estimating: Use historical cost data to bid more competitively on future work.

- Cost Control: Spot budget blowouts early and take corrective action.

- Best Practice: Develop a standardised cost code structure (e.g., ProjectNumber-PhaseCode-CostTypeCode) and ensure everyone uses it consistently. Integrate this with your accounting and project management systems.

General Ledger (GL): The Master Record

The GL is the central hub where all financial transactions are summarised. A well-structured GL is essential for producing accurate financial statements and surviving audits.

- Structure Tips: Keep it organised but not overly complex. Use specific accounts for key construction items like Work-in-Progress (WIP), Retentions Held, and Retentions Payable.

- Integration: Ensure data flows smoothly from subsidiary ledgers (sales, purchases, payroll, job costing) into the GL.

- Reconciliation: Regularly reconcile GL accounts with supporting data (e.g., bank statements, WIP schedules).

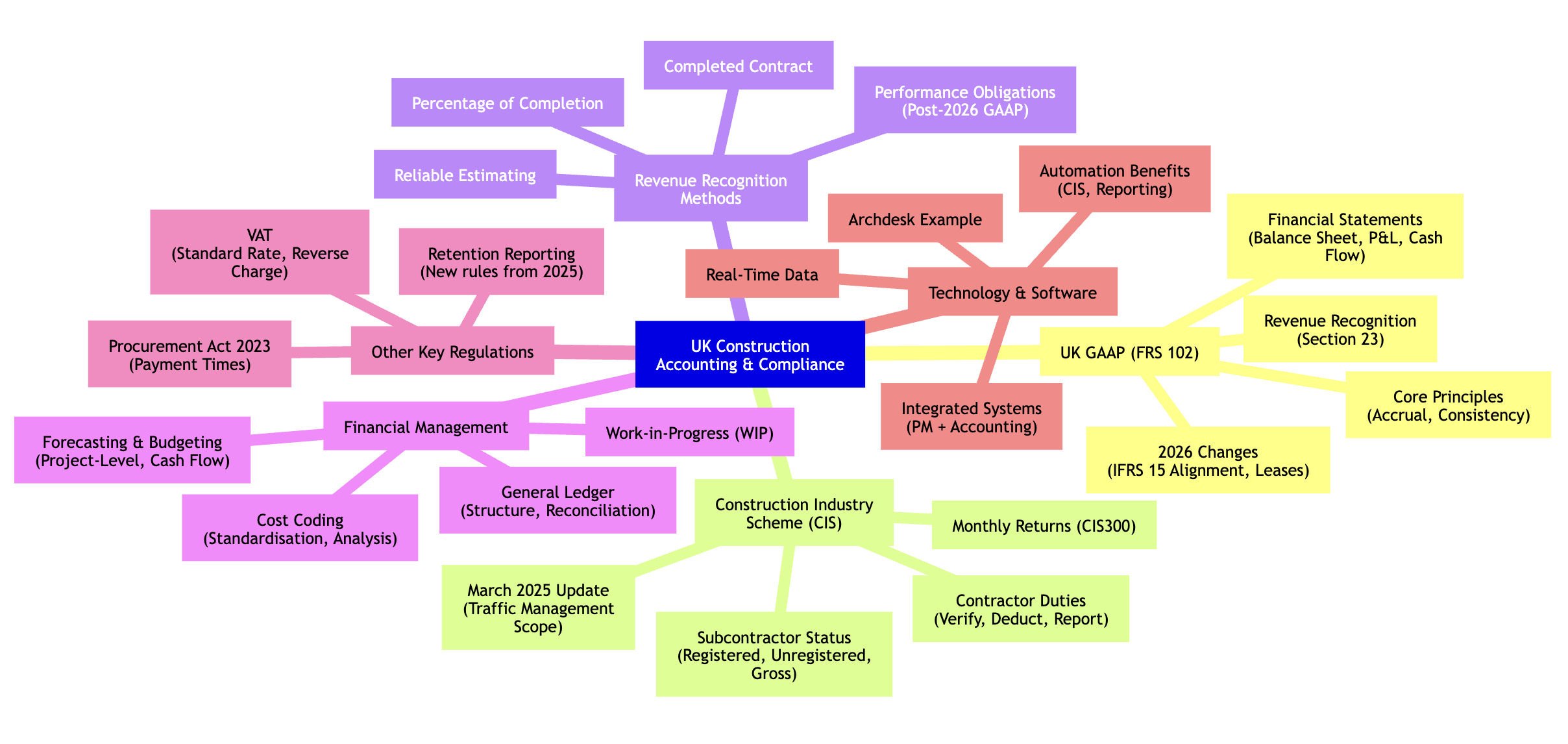

Mindmap: Navigating UK Construction Accounting Compliance

A Visual Overview of Key Areas

This mindmap provides a high-level overview of the critical components involved in maintaining financial compliance and best practices within the UK construction industry.

Other Important Considerations

VAT, Retentions, and Procurement Rules

VAT in Construction

Value Added Tax (VAT) is usually charged at the standard rate (currently 20%) on most construction services. VAT-registered businesses charge VAT to their customers (output VAT) and reclaim VAT paid on their purchases (input VAT).

- Key Point: Be aware of the VAT Domestic Reverse Charge for building and construction services. For certain services supplied between VAT-registered businesses, the responsibility for accounting for the VAT shifts from the supplier to the customer. This was introduced to combat fraud. Ensure your invoicing and accounting processes handle this correctly.

- Reduced & Zero Rates: Certain types of work (e.g., construction of new dwellings, conversions, work for charities) may qualify for reduced (5%) or zero rates. Always check the specific rules.

Reporting on Retentions (From 2025)

Retentions (holding back a percentage of payment until project completion/defects period ends) are common but controversial. New regulations are coming into force requiring large companies and LLPs that meet certain size thresholds to report on their retention payment practices in their statutory accounts.

- When: Applies to financial years beginning on or after 1 April 2025.

- What: Reporting requirements include average retention payment times and the value of retentions owed at the year-end.

- Action: If this applies to your company, ensure you have systems to accurately track and report retention data.

Procurement Act 2023 & Payment Times

The Procurement Act 2023 introduces changes to public sector procurement. A key aspect impacting suppliers is stricter enforcement of payment terms. For instance, bidders for large public contracts (over £5M) need to demonstrate compliance with payment performance metrics (e.g., paying 95% of invoices within 60 days). While this directly applies to public contracts, it sets a benchmark and reflects increasing pressure for prompt payment throughout the supply chain.

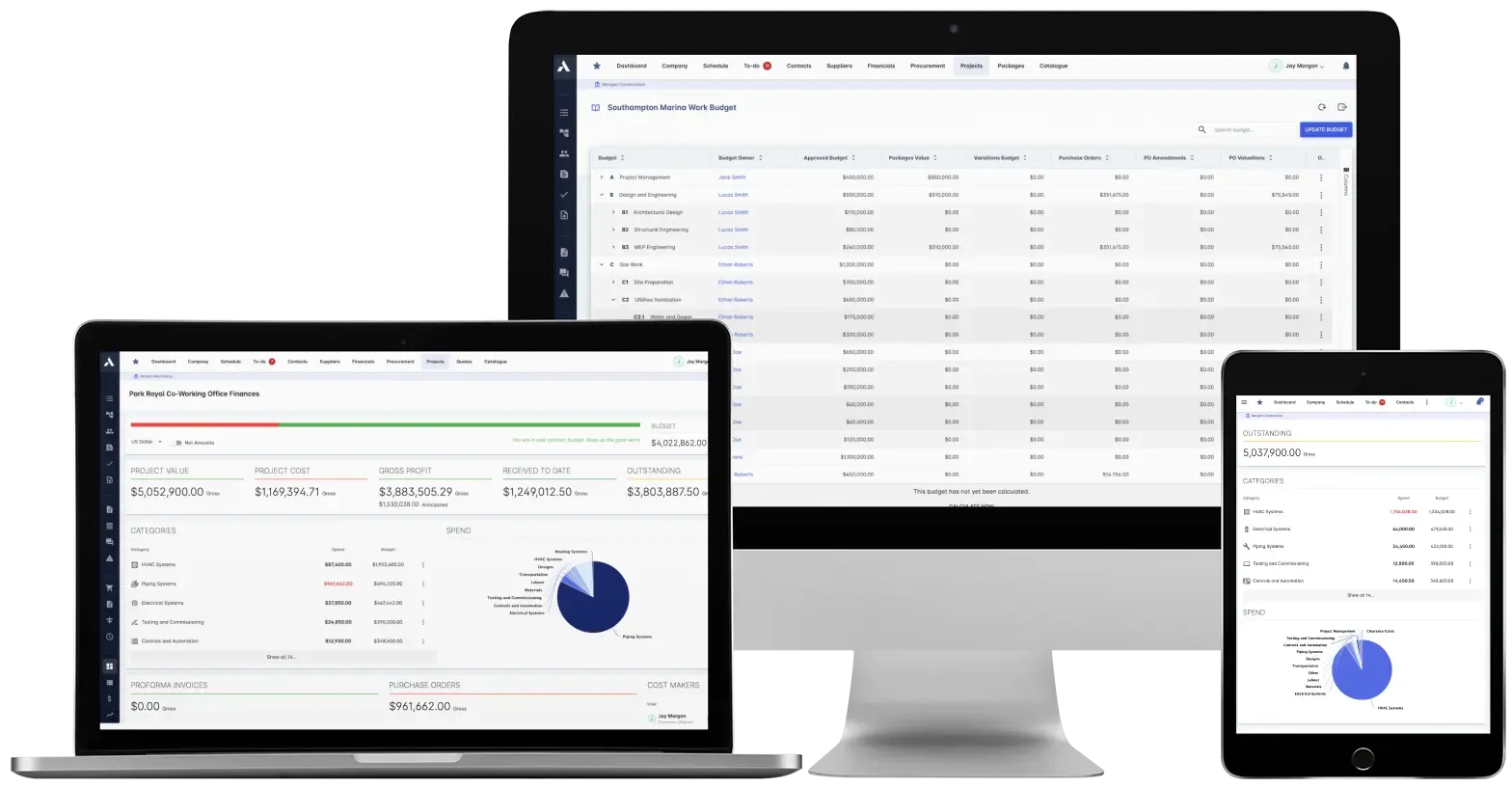

Leveraging Technology: The Archdesk Advantage

Why Integrated Systems are a Game-Changer

Managing all these financial complexities manually is a recipe for errors, delays, and compliance headaches. Spreadsheets and disconnected systems just don't cut it anymore. This is where integrated construction management and accounting software shines.

While various platforms exist (Procore, Autodesk Construction Cloud, Viewpoint, etc.), many focus heavily on site operations or document management. For truly streamlined financial control, integrating a robust project management tool that *understands construction financials* with your core accounting software (like Xero, QuickBooks, Sage) is key.

Integrated platforms provide a unified view of project financials.

Archdesk + Accounting Software = The "Beast of a Solution"

Archdesk is designed with the entire construction workflow in mind, including the critical financial elements often overlooked by purely operational software. When you connect Archdesk (handling project management, cost tracking, estimating, subcontractor management) directly to your accounting package, you unlock significant benefits:

- Single Source of Truth: Project costs captured in Archdesk (e.g., timesheets coded to jobs, supplier invoices linked to cost codes) flow directly into your accounting software. No more double-entry, reduced errors, and consistent data across the business.

- Real-Time Financial Visibility: Generate accurate, up-to-the-minute reports on project profitability, cash flow, WIP, and budget vs. actuals directly within Archdesk, pulling data from both systems. Make decisions based on current reality, not outdated spreadsheets.

- Automated Compliance: Archdesk can automate complex calculations like CIS deductions based on verified subcontractor status and generate reports needed for HMRC filings. It helps manage retentions tracking, supporting compliance with new reporting rules.

- Streamlined Workflows: Automate processes like purchase order creation, invoice approval, and payment application, freeing up finance teams for higher-value analysis.

- Improved Forecasting: Real-time cost data feeds directly into forecasting modules, allowing for more dynamic and accurate predictions of project outcomes and cash needs.

The Edge over Competitors: While platforms like Procore or Autodesk are strong in design collaboration and site management, their financial modules or integrations may not be as deeply embedded or construction-finance specific as Archdesk's approach. Archdesk aims to bridge the gap between operations and finance seamlessly, providing a more holistic financial control centre when paired with dedicated accounting tools.

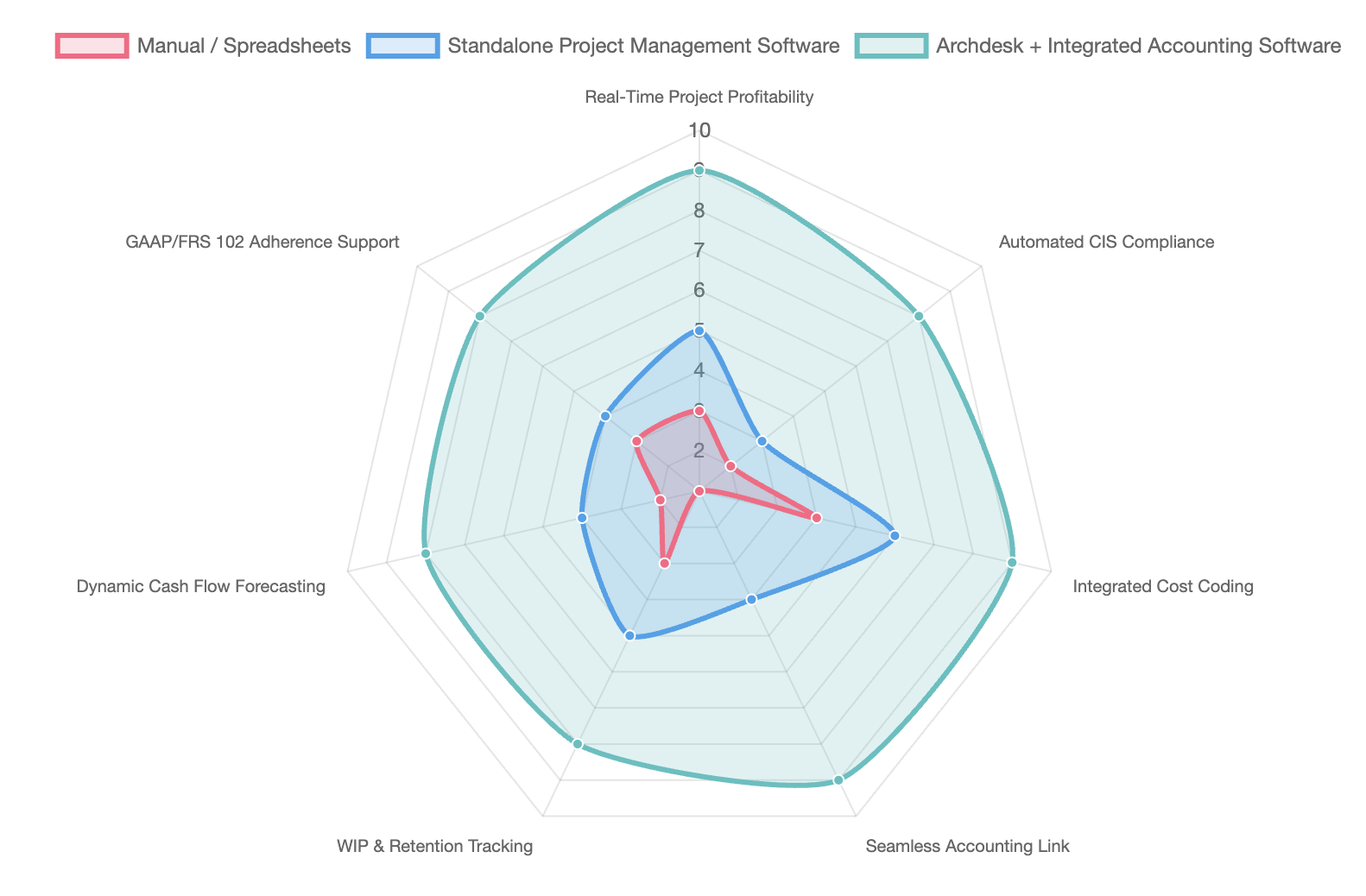

Comparative Software Approach Analysis

This radar chart illustrates a conceptual comparison of different approaches to managing construction financials, highlighting the strengths of an integrated system like Archdesk connected to accounting software.

By embracing integrated technology, construction finance leaders can move from reactive reporting to proactive financial management, driving efficiency, ensuring compliance, and ultimately boosting profitability.

Frequently Asked Questions (FAQ)

What are the biggest UK GAAP changes affecting construction from 2026?

The most significant changes stem from the FRC's March 2024 updates to FRS 102, effective for accounting periods starting on or after 1 January 2026. For construction, the key impacts are:

- Revenue Recognition: A shift towards the IFRS 15 model, focusing on identifying and satisfying distinct 'performance obligations' within contracts. This may lead to revenue being recognised later than under the current Percentage of Completion method, especially for contracts with significant service components.

- Lease Accounting: Substantial changes aligning more closely with IFRS 16, likely bringing more leases onto the balance sheet.

Businesses should review their contracts and accounting policies now to prepare for these changes.

How does the March 2025 CIS change impact payments for traffic management?

From 1 March 2025, certain traffic management services provided directly in relation to construction operations fall under the scope of CIS. This means contractors paying for services like temporary traffic lights, barriers, or road closures connected to a construction site must:

- Verify the traffic management provider's CIS status with HMRC before payment.

- Apply the correct CIS deduction rate (20% or 30%, unless the provider has gross payment status) to the labour element of the payment.

- Report these deductions on their monthly CIS300 return.

Failure to comply can result in penalties.

Why is cost coding so important in construction accounting?

Cost coding provides essential granularity for financial control in construction. By assigning specific codes to different types of costs (e.g., labour, materials, plant hire) within each project and phase, companies can:

- Accurately track project profitability by comparing actual costs against budgets for specific activities.

- Identify areas of cost overruns quickly and take corrective action.

- Improve the accuracy of future estimates and bids by using historical cost data.

- Streamline reporting and analysis, making it easier to understand financial performance at a detailed level.

- Ensure costs are correctly allocated for accounting (e.g., WIP) and tax purposes.

A standardised and consistently applied cost coding system is fundamental to effective construction financial management.

How does integrating software like Archdesk with accounting tools help?

Integrating construction project management software (like Archdesk) with accounting software (like Xero, QuickBooks, Sage) creates a powerful, unified system that offers several advantages:

- Eliminates Double Entry: Data entered once (e.g., a supplier invoice in Archdesk) flows automatically to the accounting system, reducing manual work and errors.

- Real-Time Data: Provides an up-to-date view of project financials, combining operational progress with financial data for accurate reporting on profitability, cash flow, and WIP.

- Improved Accuracy: Reduces inconsistencies and discrepancies between operational records and financial accounts.

- Enhanced Compliance: Facilitates processes like CIS verification and deduction calculations, retention tracking, and adherence to revenue recognition rules by having all relevant data in one connected ecosystem.

- Streamlined Reporting: Enables more comprehensive and timely financial and project reports, supporting better decision-making.

This integration bridges the common gap between site operations and the finance department, leading to greater efficiency and control.

References

Sources and Further Reading

- UK Construction Accounting: A Complete Guide to Compliance - CH Accountancy

- UK GAAP - ICAEW

- Construction Industry Scheme (CIS) - GOV.UK

- Changes to CIS: Traffic Management Services to be Brought Within Scope from March 2025 - Dains Accountants

- New requirements for large companies to report on construction retentions - Herbert Smith Freehills

- Changes to UK financial reporting standards - Bishop Fleming

- Construction Accounting 101: The Essential Guide (2025) - Archdesk

- FRS 102: Revenue under UK GAAP - ICAEW