If you’ve ever been on the wrong side of a disgruntled employee, you’ll know that life is much easier when you get payroll right the first time.

No employer wants to be digging through their tax receipts to work out what they owe, and you certainly don’t want to risk lawsuits, fines or industrial action for incorrect wages or poor financial hygiene.

So how do you get it right?

A quick intro to construction payroll

But here’s the issue: in construction, payroll and accounting are an absolute minefield.

You have contractors, subcontractors, federal & local taxes, union terms, government contract terms and much more.

On top of all that, you might also have separate projects in different places, workers on varying rates and benefits for specific workers.

So where on earth do you start trying to untangle all this?

Well, if you want to keep your employees happy, your business profitable and the lawsuits far away, there’s no option really than to dig into the details and get it right.

That’s why we’ve bought together everything you need to know in this post to help you get started.

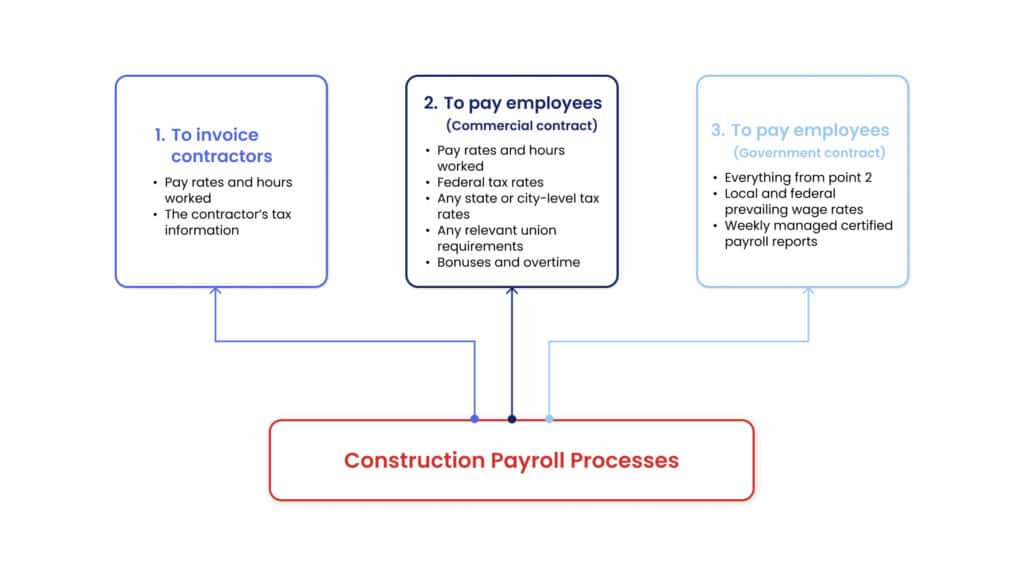

But first, here’s a quick TL;DR of everything you need to include or remember in your construction payroll processes:

- To invoice contractors

- Pay rates and hours worked

- The contractor’s tax information

- To pay employees (commercial contract)

- Pay rates and hours worked

- Federal tax rates

- Any state or city-level tax rates

- Any relevant union requirements

- Bonuses and overtime

- To pay employees (Government contract)

All of the above plus:

- Local and federal prevailing wage rates

- Weekly managed certified payroll reports

If you don’t know where to start with some or all of these, don’t worry – we’ve got plenty more details to help you out below.

But first, let’s work out what kind of workforce you either need or already have.

In-house vs. outsourcing: Choosing the right workforce

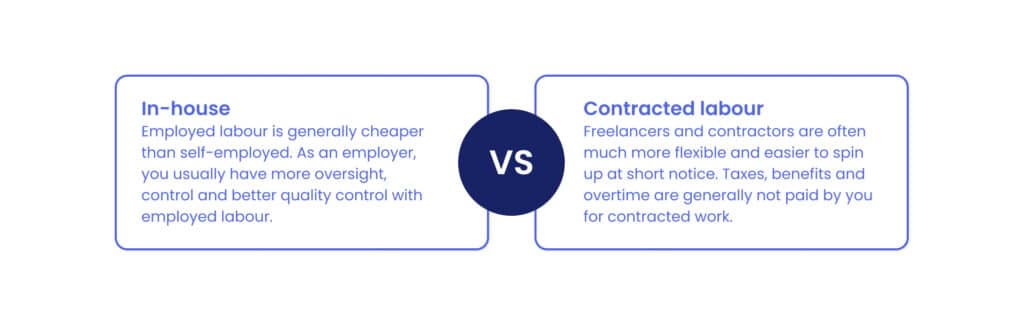

Before we get into construction payroll, it’s first important to identify what kind of workers you’re using – as that will affect the rates and taxes you’ll pay.

There are pros and cons to each, and the right solution will depend on the particular project and its requirements.

Here are the main reasons to choose each option:

- In-house

- Employed labour is generally cheaper than self-employed.

- As an employer, you usually have more oversight, control and better quality control with employed labour.

- Contracted labour

- Freelancers and contractors are often much more flexible and easier to spin up at short notice.

- Taxes, benefits and overtime are generally not paid by you for contracted work.

Whichever you choose, it’s important to make sure you’re being honest about which category your workforce falls under. If employees are masquerading as contractors, you could end up on the wrong side of federal law.

A good acid test is if a particular worker is doing most or all their work for your company - they’re probably an employee.

Everything you need to remember for effective construction payroll

When it comes to construction payroll, there are several things you need to remember.

Some of these, like federal taxes and bonuses, work just the same as they do in any other industry. But as ever with construction, there are certain unique challenges you’ll have to get on top of.

Here are the main things you need to remember:

- Pay rates

Varying pay rates are one of the key challenges in construction payroll.

At any time, you’re likely to have multiple projects on the go, across several sites, involving both employed and contracted labour.

The rate of pay will differ from worker to worker and site to site – so it’s important to keep track of who gets paid what.

The best way to do that is to have different job codes for each rate of pay and ensure all timesheet data corresponds with these codes.

- Multi-state/city requirements

Just like in any other sector, you need to be aware of what taxes you and the employee owe when paying wages. But in the US, you don’t just have one set of rules to grapple with.

That would be too easy.

All US payroll is first subject to federal tax, which is usually about 7% each for the employer and employee. Remember that the employee’s contributions will be taken out of their salary – but you’re still responsible for ensuring it’s paid.

But on top of that, there’s a good chance you’ll also have state or city-specific taxes and labour laws to grapple with - depending on where you’re working.

You might even have projects that cross city/state lines, meaning different taxes will be owed in each.

So where do you even start with this? Well, it can certainly be a minefield, but it helps to ensure your workers’ job codes correspond to a specific set of regulations.

If an employee works in Michigan one week and Ohio the next, a distinct job code should be created for each of these, even if the rate of pay is the same.

This makes it easier to associate hours worked with the relevant set of regulations, so you’re more likely to get it the right first time.

- Bonuses and incentives

You might wish to offer performance, milestone or incentive-related bonuses to employees. This is particularly relevant to project managers, who are often incentivised to ensure projects are delivered on time and within budget.

If so, you need to distinguish which bonuses are relevant in the job codes you provide, making sure to assign the right bonuses to the right employee.

You should also make sure that any bonuses are subject to the relevant federal and local tax rates.

- Overtime and shift differentials

Under federal law, if an employee works more than 40 hours in a week, they are entitled to overtime pay at 1.5x – or time and a half.

This applies to all employees, no matter their base salary rate, but not to freelance or contracted labour.

If this isn’t offered, you could be subject to fines or lawsuits – so it’s important to ensure you have a system in place to automatically compensate workers when they work longer hours.

- Union payroll

If you’re working with unionised labour, you’ll likely have certain payment terms and rates that you’ll have to honour to avoid a lawsuit or fine.

This could include effective payment dates, particular ways of paying, minimum payment terms for specific projects and any additional benefits. These will generally differ from union to union and state to state.

Individual workers may also report to multiple unions in different situations - so it’s important to be on top of the details here.

Again, job codes are your friend here: if workers are subject to varying terms for separate projects, those hours should be filed under distinct job codes.

- Prevailing wage

Here’s where things start to get more complicated. If your employees are working on government contracts, you have another set of regulations and standards to grapple with – known as prevailing wages.

In short, this is a set of rules that contractors must follow if they’re working on public contracts. This involves minimum rates of pay (relative to the local area) as well as terms such as when and how often payroll needs completing.

The most important and well-known rule here is the 1931 Davis-Bacon Act.

This federal law applies across the US, though many states will have their own local prevailing wage requirements that you will also need to consider.

In practice, this means workers may have separate pay rates and terms for commercial and public projects – meaning separate job codes might be required.

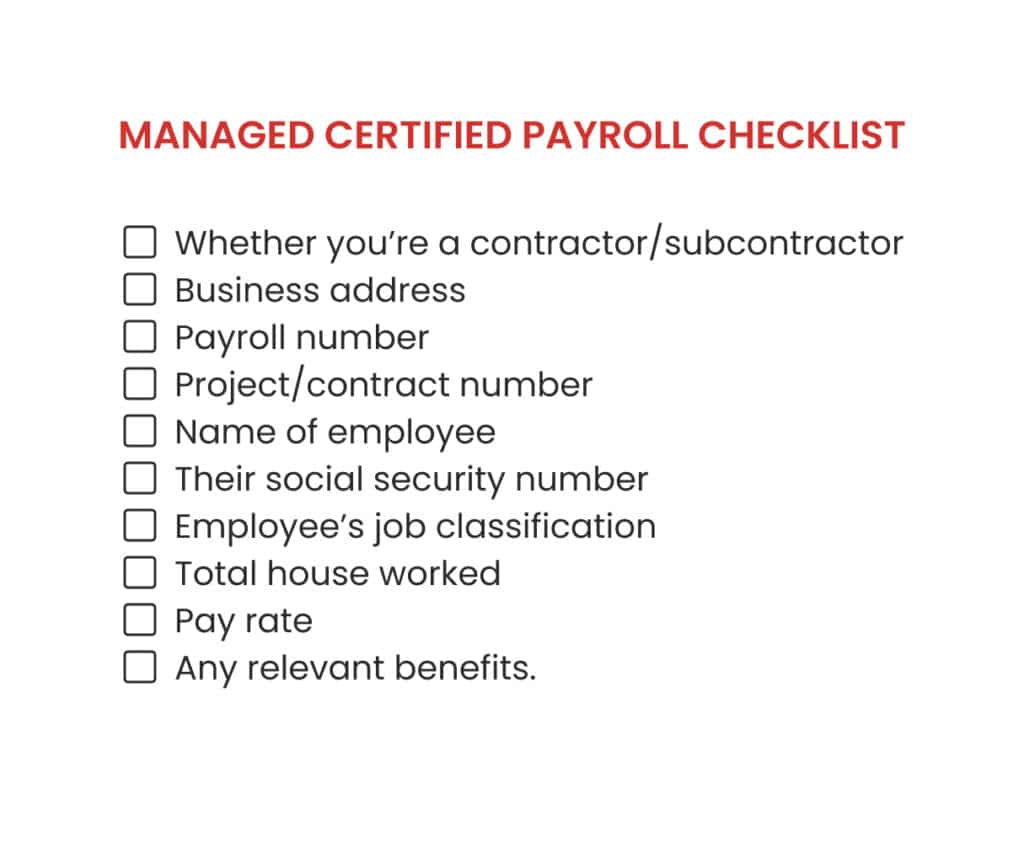

- Managed certified payroll

If you’re working on a government project, you’ll also need to complete weekly payroll reports, known as Wh-347, or managed certified payroll. This is so the government can ensure prevailing wage terms are honoured.

Your reports must include:

- Whether you’re a contractor subcontractor

- Business address

- Payroll number

- Project/contract number

- Name of employee

- Their social security number

- Employee’s job classification

- Total house worked

- Pay rate

- Any relevant benefits.

You can find out more about what to include and how to fill out the forms here.

Best practices: How to get construction payroll right the first time

If you’ve made it this far, hopefully, you know a little more about what’s involved in construction payroll. But with so many different workers, contractors, tax rates and regulations to be aware of – getting it right still isn’t easy.

Here are a few tips to point you in the right direction:

Always track workers’ time

Time tracking really is the key to an effective payroll process.

If you’ve got an accurate, up-to-date outline of which employees or contractors have worked on which projects, and when, it’s going to be much easier to calculate the relevant taxes, benefits and overtime associated with those hours.

When searching for time-tracking software, you should look out for a solution that updates instantly and can automatically associate hours worked with particular job codes.

Different regulations = different job codes

By far the best way to calculate payrolling is to have pre-set job codes that correspond to specific sets of regulations.

If an employee works 6 hours on a commercial project one day, then 4 on a public sector contract the next – these should be listed under separate job codes.

That way, it’s much easier to distinguish what taxes, overtime, benefits and others are relevant to which hours worked.

Streamlining payroll process

As well as having the right software and job codes, it’s also important to streamline the payroll process as much as possible.

To do this, you should establish clear company policies for when payroll must be complete, with which systems, as well as how and when employees should log their hours.

This reduces room for ambiguity and makes it easier to get everything completed on time.

Maintaining payroll records

It’s also important to maintain scrupulous records of who is paid what and when. This, first of all, makes it easier to calculate the correct rates and taxes.

But most importantly, it means you’ve got the evidence to help with any future disputes – either with employees or the taxman.

You should regularly audit your own records to ensure they’re both comprehensive and compliant. The best way to manage this, by far, is digital.

Cracking construction payroll

In summary, construction payroll isn’t easy – but it’s vital to get it right, and there are ways to make it easier.

Crucially, this starts with getting the right software. It is (just about) possible to track every hour worked, tax paid and benefit given through Excel or on paper… but unless you have an infinite amount of time and patience, it’s probably not going to work in practice. So where do you go from there?

That’s where Archdesk comes in. As a construction-specific tool, our software can help you manage the complexities of different tax rates, benefits, overtime requirements and much more – wherever you or your team are working.

Get in touch today to find out more.

Frequently Asked Questions (FAQs)

What is construction payroll?

Construction payroll refers to the process of calculating wages, taxes and benefits for employees and contractors in the construction industry.

What are the key components of construction payroll?

Here are the key things you need to remember when calculating construction payroll: pay rate, hours worked, federal tax rates, state/city level taxes, union benefits, bonuses and overtime. For public contracts, you also need to be aware of prevailing wage rates and create weekly managed certified payroll reports.

What are the best practices for construction payroll?

The best practices for effective construction payroll are: Remember to track time, always use distinct job codes for different projects, create clear company policies and maintain scrupulous records of who is paid what and when.