Construction Tips, News & Best Practices

Construction Financial Management in 2023: The Ultimate Guide

-

Do you feel your techniques and tools for construction financial management aren't enough?

-

Do you sometimes go over budget due to poorly estimated project costs?

-

Do you face problems with managing your company's cash flow?

You're not alone in those challenges.

In this guide, you'll find answers to the most common questions with tips and best practices that will help you ensure your company's financial safety.

What is meant by construction financial management?

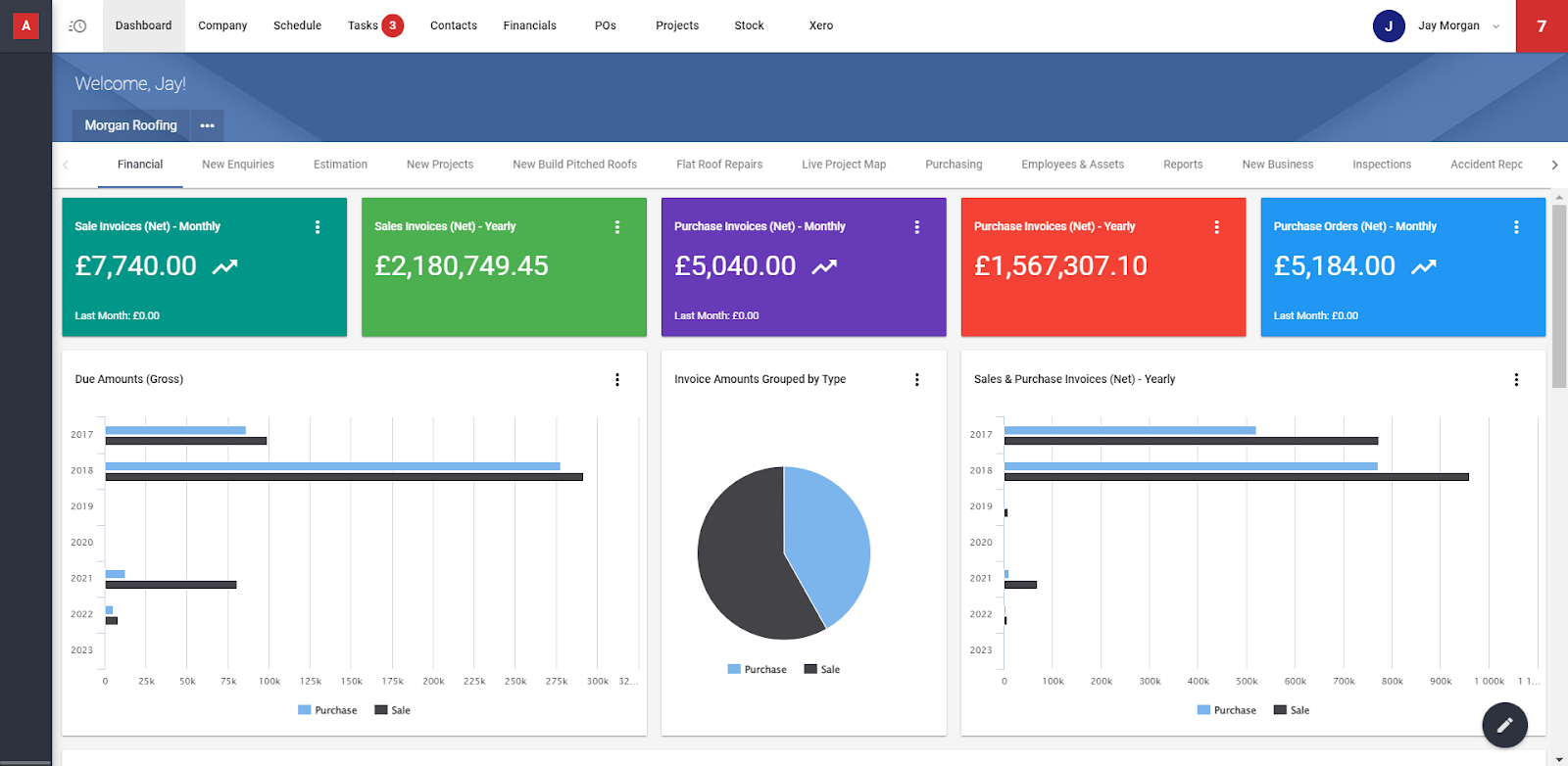

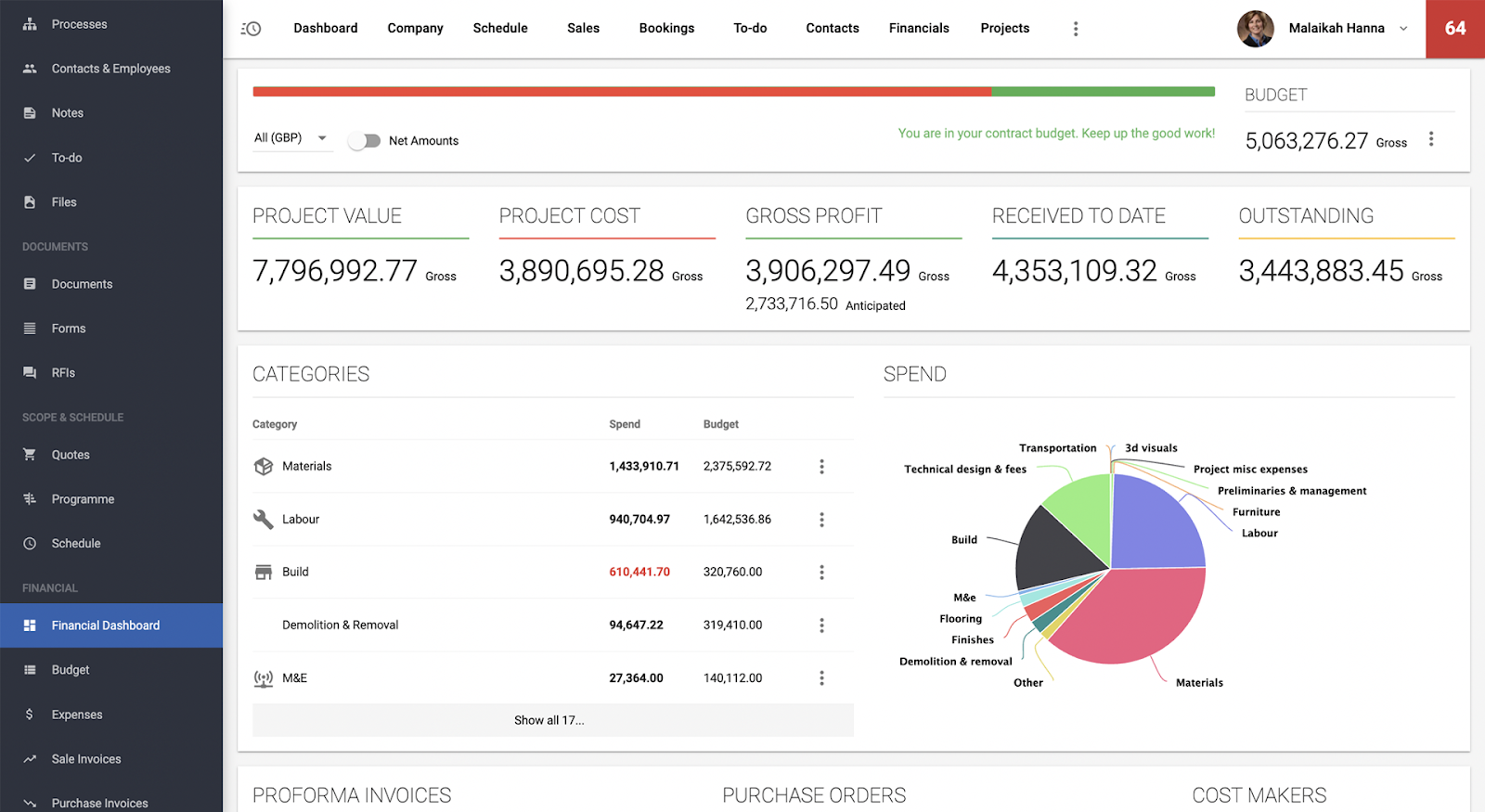

This is how managing your construction finances looks inside Archdesk

Construction financial management is allocating and accounting for financial resources to cut project costs, maximise profits and assure long-term company financial health.

Every decision impacts your financial position. That's why in proper financial management, every process matters, from small purchases to structural changes on a business level.

Yet, to be able to analyse your situation, you need to gather, organise and learn how to manage financial data.

The importance of doing construction financial management right, with no workarounds

Workarounds might be a good solution for managing risks or unpredicted changes. But, basing your whole construction project's financial management on them is not a good strategy:

Waste of your time and energy

Building workaround spreadsheets every time costs you time and energy. After all, you must take the financial data from a primary source, create a workaround and manage the information.

In the 21st century, construction companies must be fast and efficient to stay on the market.

If you spend your time creating contemporary worksheets, you have no time left for actions that matter- like winning more businesses.

Lack of complete financial overview

Workarounds for many construction managers seem to be a faster and cheaper way of managing finances. Especially when the alternative is a pricey system.

They don't see that operating only on workarounds is the nail in the coffin rather than the key to success.

With many detailed worksheets, you lack the crucial aspect: an overview of the company's financial health.

You can't see how decisions impact your company which means you have zero control over what's happening with your business.

Higher risk of manual errors

Did you know there's a 40% chance of committing an error while manually entering data into spreadsheets? The risk reaches 100% if you deal with complex files.

Still, many construction companies manage their finances only in spreadsheets.

The human eye cannot catch an error in loads of financial data. That's why putting all your financial management on manual work is doomed to fail from the beginning.

Knowing where the money is going and how to allocate that money will separate a good construction manager from a great construction manager.

- Damen Edwards from Construction Management Podcast

What makes construction financial management different from the financial management of companies outside the construction industry?

Standard accounting systems can’t handle construction financial processes

Most industries operate on annual reporting. The construction industry is much different. Construction projects last even up to 10 years (or even longer) and can be fully billed only after the end of the execution.

Because of that, a typical accounting system isn't always a good fit for a construction company.

If an accounting system operates on 365-day financial reporting, it might cost you too much time, effort, and money to adapt it to your specific needs.

Each construction project requires a separate estimation

Unlike many other industries, construction is project-oriented. It means that project cost changes every time (even if it's the exact scope of work). Weather conditions, localisation, or contractor's terms are only a few variables that impact your project management.

If main contractors don't want to underestimate costs and risk overspending, they must consider all the financial aspects while creating a proposal. It means they must already spend time and effort before even knowing they got the job.

Construction payable is much more complex

Payment terms on construction contracts vary a lot depending on the construction branch. Along with them come different types of financial reporting, budget control techniques, or strategies for measuring financial progress.

Such a situation is challenging for all participants in a construction act. From a contractor's perspective, he has to adapt to multiple construction contracting methods, which makes financial management much more demanding and complicated.

If you try to run the building business books the same way as most other businesses, you are always going to be coming up with a picture that is not accurate. There are some unique elements in the construction industry that if you don’t take them into account, you end up with a problem.

- APB’s Head Coach, Andy Skarda, in Professional Builders Secrets

Top 3 construction financial management challenges

No real-time view of project costs and their impact on project financial health

Many project managers don't know if their project is profitable till the very end of the execution. They can't see where and why they are losing money. It's a common but severe mistake for the company's financial health.

The reason for that isn't a lack of financial data. Instead, it's due to a lack of techniques and tools to analyse them. As a result, construction managers don't have any possibility to react when a risk occurs.

Difficult cash flow management- payment terms in the construction industry

Cash flow management is a nightmare for many construction companies.

The average time to get paid is 60 days, while even one in five subcontractors must wait up to 90 days. With such conditions, it's incredibly challenging to plan future investments and not stress about financial stability.

Payment terms are not the only challenging aspect of financial management. Companies also have to deal with low-profit margins and a lack of regular income (usually at the project's beginning or end).

The complex reality of financial data

Project management success in the construction industry depends heavily on external factors. Even if a company invests time and effort to prepare the most accurate estimation, the situation of the project can change at any time.

The leading external financial challenges for construction in 2023 are inflation and material supply chain problems. They hit companies' financial stability heavily, taking cash flow levels necessary to survive in the market.

Who is responsible for construction financial management in a construction company?

Business Owner

The Business Owner is usually responsible for managing financially small and medium-sized businesses. He’s the main person in charge of making financial decisions, executing construction contracts, and sometimes even the tendering process.

CFO

CFO (Chief Financial Officer) is a professional dealing with strategic financial management in larger companies. Along with the CEO, he’s focusing on a broad perspective and long-term growth path.

Financial Manager

The Financial Manager is often confused with the CFO position. While the scope of work might seem similar, construction financial managers focus more on daily operations and implementing financial strategy from the board.

Project Manager

The Project Manager is the primary person responsible for the financial management of a project. To deliver a construction project, he must be familiar with techniques for managing risk, financial reporting, and progress monitoring.

Accounts Payable

The account payable clerk provides financial, administrative, and payment support for a construction company. He's responsible mainly for verifying invoices, running subcontract accounts, and making interim payments.

Quantity Surveyor

A Quantity Surveyor is a professional dealing with financial and contractual aspects of construction projects. With extensive practical knowledge, he controls project execution and advice on the better allocation of financial resources.

How to choose construction financial management software?

Construction management software can be a great support in making financial decisions. When reviewing available options on the market, focus on the following features.

Budgeting

The budget is the core of any construction project management. Good management software should provide a real-time view of your project's execution. It means showing you how your project is doing at each execution stage.

Thanks to that, you will be able to track financial progress and make decisions using complete data you can trust. Also, you'll be able to react faster in case of sudden change and save your work from a financial fiasco.

The financial dashboard should be a primary source of information when managing your project's financial health.

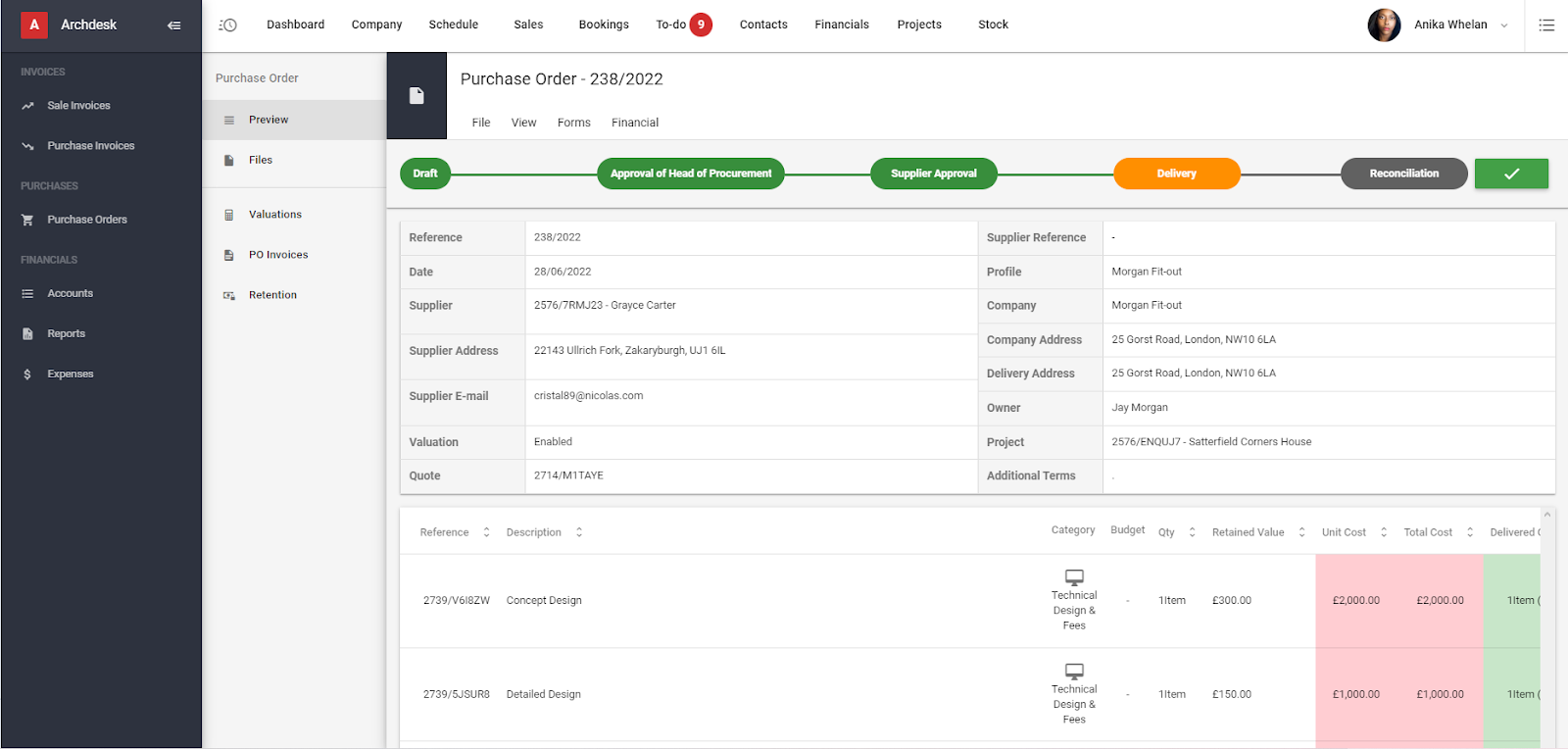

Procurement

Organised procurement is a must for the financial health of your construction company. Especially nowadays, when the materials' prices are constantly growing, unplanned purchases might undermine your financial stability.

That's why you must search for software with a procurement solution that gives you complete visibility over the company's purchase orders.

Thanks to that, you'll be able to communicate with suppliers faster and decrease the risk of project delays.

With all the purchase details stored in one place, you can rest assured of timely delivery and no risk of overspending.

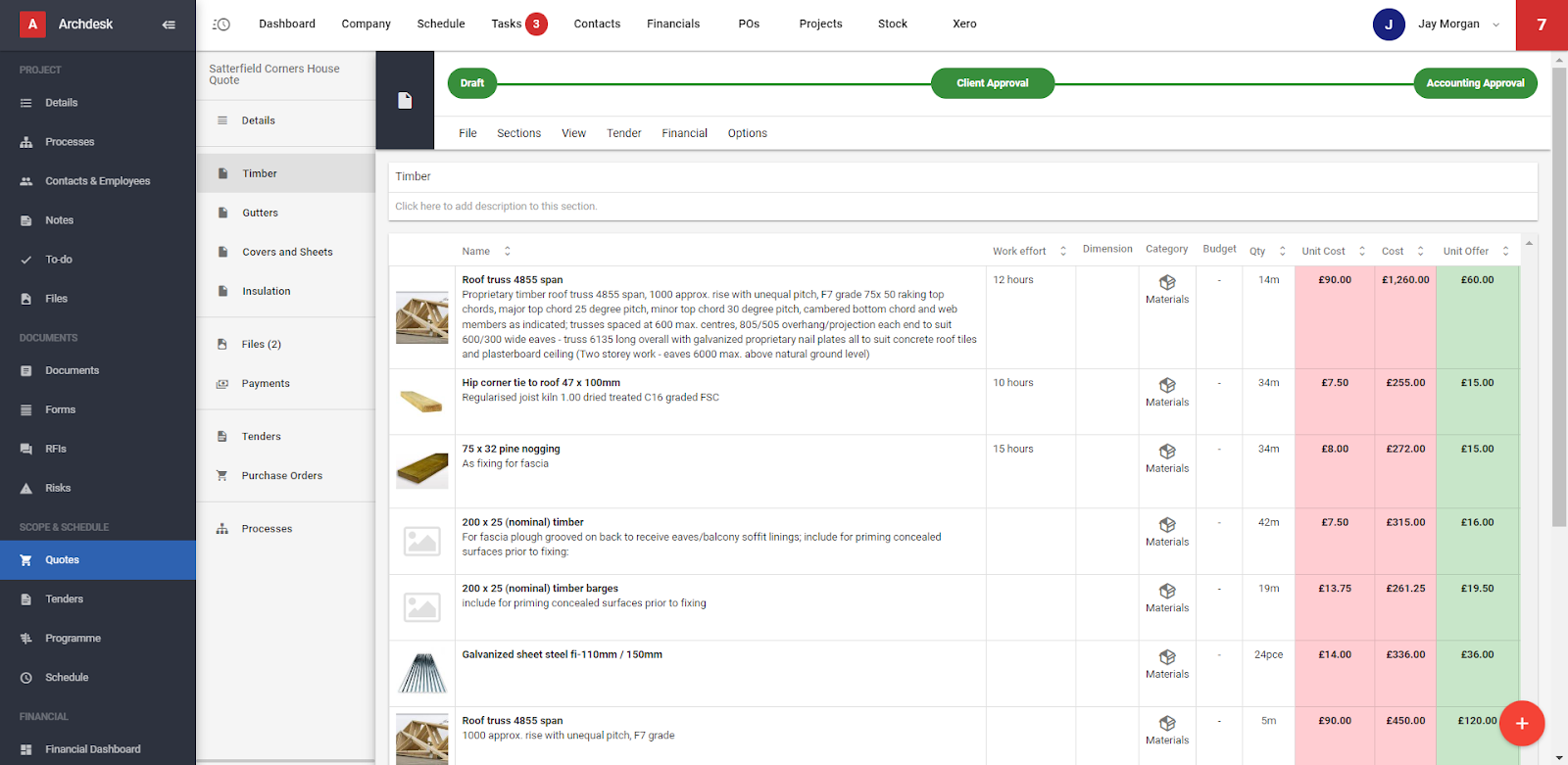

Estimation & Quotation

Don't let your construction project be one of the 39% that fail. Choose a construction management software that can improve and streamline your estimation process.

Check the features carefully and invest in a tool that can tailor to your process of creating pricing documents.

With customised options, you'll be able to speed up the estimation & quotation process while earning the most possible from your future projects.

A management tool that can mirror your company’s structure and customise it to your financial processes will be a real support in project management.

Best tools for construction project financial management

Xero

Xero is accounting software for small businesses, accountants, and bookkeepers. It provides solutions for tracking and paying bills on time, financial reporting, and seamless connections with bank accounts.

Xero is a good choice mainly for the accounting department and employees working with invoices, payments, or financial documentation.

At the same time, it's essential to remember that Xero works according to accepted accounting practices. It means that it's not able to address financial challenges specific to the construction industry.

So, before investing, check out which construction management systems can integrate with Xero.

Spreadsheets

Good old Excel Spreadsheets. They are the most common (and free) tool for managing financial data. Yet, they aren't a perfect solution.

If you want to improve your financial management and ensure the company's financial stability, excel spreadsheets aren't enough.

They lack an overview of the company's financial position and have a high risk of manual mistakes while entering data.

However, Excel can be a great addition to proper construction software.

For example, you can import/export data from the software to a spreadsheet and send it to an external client while not risking any data loss.

Archdesk

Archdesk is a business management platform that solves construction-specific finance challenges.

In the software, your construction data are visible in clear, easy-to-read dashboards, giving you complete control over project execution.

You can plan, manage and track the allocation of your resources as financial dashboards update whenever a new expense is added.

Also, the software integrates with the most popular accounting systems (like Xero or Sage50). So, you can perform entire accounting processes without fear of data loss or manual errors.

Level up your construction financial management

Managing finance in construction is not easy. To assure the financial health of your business, you must:

-

adapt to the specifics of the construction market (payment terms, low margins, lack of regular income)

-

be aware of internal and external challenges for your project management, like growing costs of construction materials

-

spend a lot of time on the estimation process while at the same time being flexible about possible changes in the project's execution

Luckily, you're not alone in this challenge. With proper construction tools, you improve financial health and assure the company's financial stability in the long run.

You might also like

February 29, 2024 • 7 min read

Utilizing the human-first approach to construction projects to drive higher results.

July 3, 2023 • 6 min read

8 Best Construction Drawing Management Software (2023): A Comprehensive Guide

Find all the information you need about the construction drawing management software tools available on ...June 14, 2023 • 6 min read

The 11 Best PlanGrid Alternatives (2023)

Looking for a great alternative to PlanGrid software? Check out the 11 best construction software tools ...June 14, 2023 • 4 min read

How to win at CIS 340 and make taxes a breeze

CIS 340 is a legal obligation for contractors. But getting it right isn’t straightforward. Want ...