You know what keeps construction CEOs up at night? It’s not just a delayed shipment or a sudden downpour, though those can be real headaches. Honestly, it’s something quieter, something that can sink a profitable company faster than any storm. It’s the nightmare of negative cash flow.

We’ve all seen it happen. A company lands a huge project, the books look fantastic on paper, but the bank account tells a different story. They’re waiting on payments, but the bills for materials and payroll can’t wait. It’s a brutal squeeze. In fact, a staggering number of construction firms fail not because they aren’t profitable, but because they simply run out of cash at the wrong time. It’s a survival skill, plain and simple.

Why Construction's Cash Flow is a Minefield

Construction is unique, isn’t it? You have to front a small fortune for materials, equipment, and labor long before you see a cent from the client. That gap between spending and getting paid? That’s the danger zone. It’s like paying for a massive dinner party and hoping your guests remember to Venmo you later. This gets even trickier with multiple projects running at once. Each one has its own rhythm of costs and payments. Without a clear view, it’s easy for the financial health of one project to mask the problems brewing in another.

Delayed payments from a single client can suddenly put your entire operation in a bind, making it tough to pay your own subcontractors on time. And you know how that goes—strained relationships and a hit to your reputation.

The Usual Suspects: Where Your Cash Disappears

So, where does the money go? A few common culprits are almost universal.

Unexpected Cost Overruns

A design change here, an unforeseen site condition there, and suddenly your carefully planned budget is out the window. These aren’t rare; they’re everyday traps that can turn profitable jobs into money pits.

Seasonality and Stacked Projects

A harsh winter in North America can bring work to a halt, stopping your inflow while fixed costs keep right on ticking. Or consider the summer slowdowns in the GCC or public holidays in Europe—timing really matters. Multiple jobs only amplify these timing gaps.

Delayed Payments and Retainage

But perhaps the biggest headache is just getting paid. The industry’s payment cycles are famously long. You finish a milestone, send an invoice, and then… wait. And wait. This isn’t just annoying; it’s a direct threat to your liquidity. Relying on manual processes or a patchwork of spreadsheets to track who owes what and when is a recipe for disaster. Things get missed, and suddenly you’re reacting to a crisis instead of planning for growth.

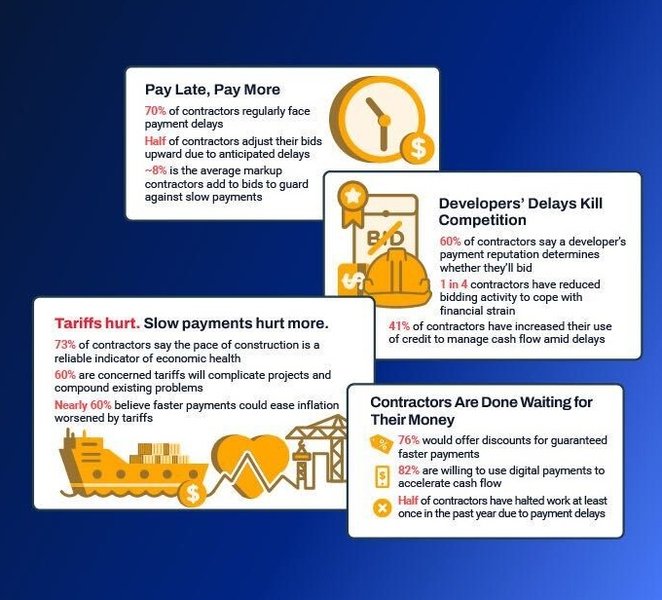

And then there’s retainage—that 10% held back, plus delays on pay apps, lien waivers, and inspections. It’s money earned but parked, creating a persistent cash flow gap. Some studies even show that construction payments can take over 80 days on average, much longer than in most other industries. That’s a long time to wait when you’ve got bills to pay!

Change Order Chaos

Extra work without immediate paperwork equals unfunded scope. It chips away at liquidity, adding another layer of complexity to an already challenging financial landscape.

Mismanaged Inventory and Price Swings

Steel, lumber, diesel—you’ve seen the spikes. Stocking up helps manage price risk but ties up valuable cash, further straining your financial position.

Spotting the Warning Signs Early

Before things spiral, watch for red flags. It’s like driving without a dashboard—you feel the bumps but can’t see the cliff ahead. Are your accounts receivable piling up while payables scream for attention? That’s a classic sign. Or maybe you're dipping into personal funds to cover payroll—a short-term fix that bites hard later. Poor estimating can lead to cost overruns; one miscalculation on rebar quantities, and your margins vanish.

Here are some more specific indicators you shouldn't ignore:

- Days sales outstanding (DSO) climbing past your normal range.

- Pay applications approved but not collected; aging creeps into the next month.

- Subcontractor calls become more frequent, and suppliers pull early pay discounts.

- More unapproved change orders than approved ones.

- Work in progress (WIP) shows profit fade while the cash position tightens.

- Your “cash cushion” shrinks below two payrolls.

Payment delays are a significant threat to contractors, often causing cash flow crises.

Taking Control: It's About Visibility

The fix isn’t about working harder; it’s about seeing clearer. You need a real-time view of your financial landscape. This means moving from guessing to knowing. Honestly, it’s a game-changer. Without a good grasp on cash flow, even a profitable project can face serious trouble. It’s not just about losing money; it’s about slowing down or even halting projects altogether.

When funds are tight, paying subcontractors and suppliers on time becomes a real challenge, and that can damage crucial relationships. Plus, if you can’t pay your workers, they’ll find opportunities elsewhere, which is definitely not good for business.

Practical Ways to Steady the Ship

So, how do you fight back? Start simple: forecast like your business depends on it, because it does. Map out inflows and outflows for the next few months, factoring in worst-case delays. Negotiate better terms with clients—push for quicker payments or progress billing. And track everything religiously; manual spreadsheets might work for a garage reno, but for bigger gigs? They're a recipe for errors.

Forecast Weekly, Not Monthly

A rolling 13-week forecast forces honest conversations. Include retainage timing, committed costs, and probable change orders. This granular view helps you anticipate future challenges.

Tighten Billing Rhythm

Bill on milestones or percent complete like clockwork; no skipped cycles. Submit clean packages with required documents to avoid rejections. Every delay in billing translates to a delay in cash inflow.

Enforce Change Order Discipline

Field tickets the same day, priced within 48 hours, interim billing where contracts allow. Unapproved change orders are often a silent drain on liquidity.

Negotiate Favorable Terms

Push for mobilization advances, shorter payment terms, and early release of partial retainage on long projects. Some owners might trade faster approvals for cleaner billing and status visibility.

Match Payables to Inflows

Use due dates, not vendor habits. Don’t pay early unless discounts beat your borrowing cost. Protecting your cash means being strategic about outgoing payments.

Protect Lien Rights

Notices sent on time, waivers conditional on cleared funds. This safeguards your interests in case of payment disputes.

Build a Real Contingency

Aim for three to six percent of annual revenue in accessible cash or committed credit. It’s not ideal, but it’s absolutely necessary for those unexpected bumps in the road.

The Power of Technology: Your Financial Navigator

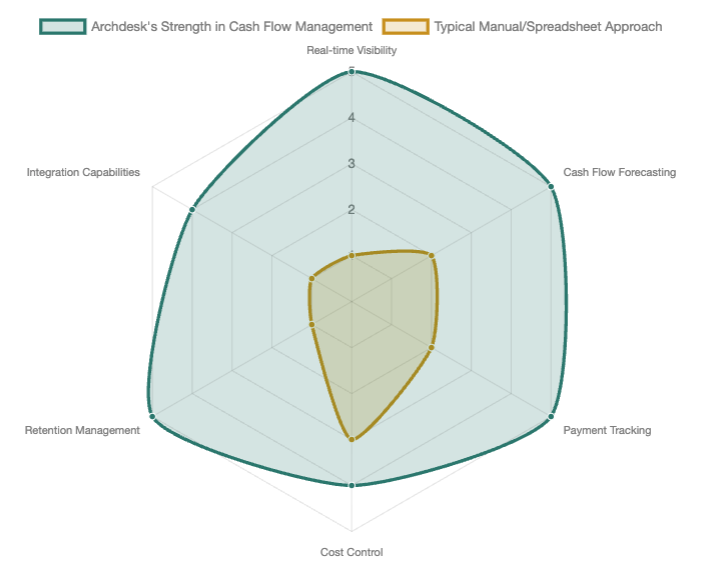

This is where a dedicated construction management platform makes all the difference. With a system like Archdesk, you move from reactive scrambling to proactive control. Imagine having a live dashboard that shows you every incoming and outgoing payment across all your projects. You’d know exactly where you stand today and where you’ll stand next month. Other tools like Procore or Buildertrend offer general project management, but Archdesk really zeros in on the financial flows.

This radar chart illustrates the perceived strengths of Archdesk in various aspects of cash flow management compared to traditional manual or spreadsheet-based approaches. A higher score indicates better performance and capabilities.

How Archdesk Shields Your Business

Archdesk helps you create that vital cash flow forecast, letting you model different scenarios before you commit. What if that big payment is two weeks late? What if we need to purchase that equipment sooner? You can see the impact instantly and plan accordingly. It automates the tedious stuff—tracking retention, monitoring payment schedules, processing invoices—freeing you up to actually analyze the data and make smart decisions.

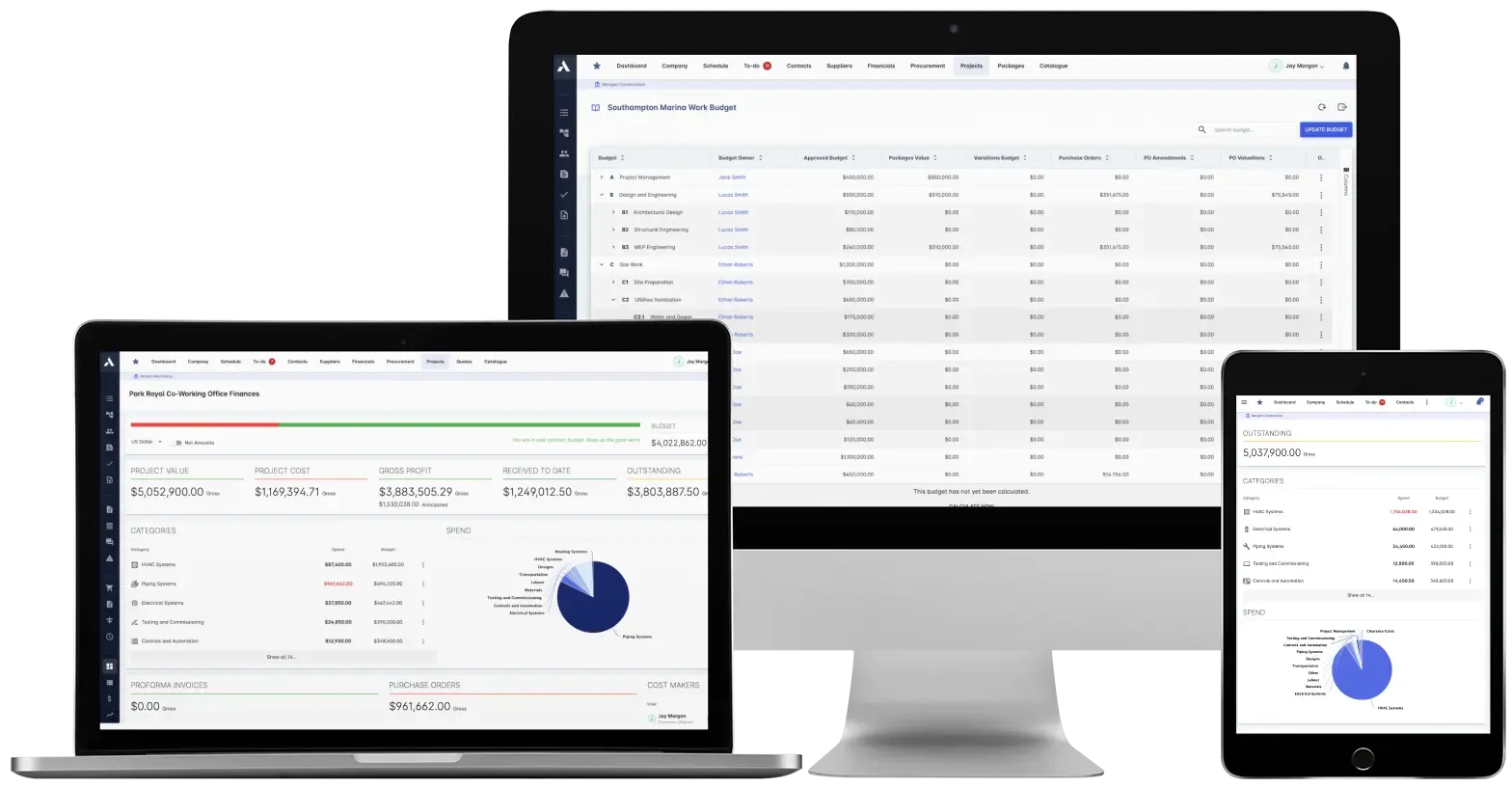

A clear financial dashboard is crucial for understanding project health at a glance.

You don’t need noise; you need clarity. Archdesk puts financial control at the center with features like:

- Payment tracking: Live status on every receivable and payable, with due dates, milestones, and retention aging. You see what’s stuck, where, and why.

- Cash flow forecasting: Project and portfolio forecasts that update from actuals, change orders, and schedules; scenario modeling for "what if the owner pays in 45 not 30" or "diesel up 8 percent."

- Retention management: Track holds and release dates on both sides, so you don’t get surprised at closeout.

- Cost control and WIP: Budget versus actuals in real-time, variance alerts, and revenue recognition that mirrors progress, not guesses.

- Accounting integrations: Keep QuickBooks, Xero, Sage Intacct, or similar as your ledger while Archdesk drives project-level truth. Less double entry, fewer mismatches.

The goal is to shield your business from the unexpected. With clear visibility, you can protect your cash inflows and outflows, uncover growth opportunities, and finally get a good night's sleep. The difference between just surviving and truly thriving often comes down to who has a better handle on their cash. Isn’t it time you took control?

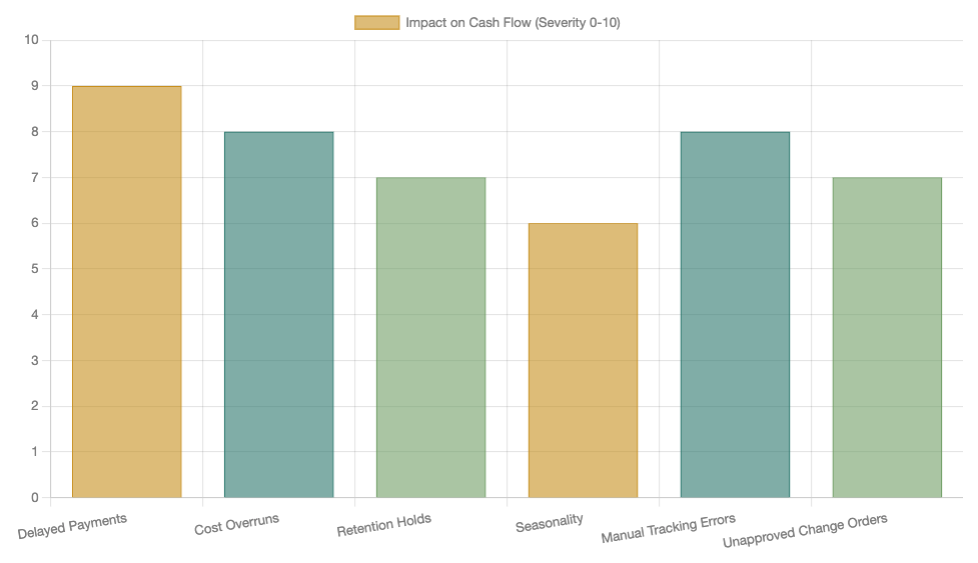

This bar chart illustrates the relative impact of various common construction challenges on a company's cash flow. Higher bars indicate a more significant challenge.

The "Quiet Test"

If you paused reading and thought about one project that’s “fine,” check its cash curve, not just its margin. If the curve dips below zero for three weeks, that’s your risk. It’s that simple. Managing cash flow isn't about dodging nightmares forever; it's about sleeping easier knowing you've got controls in place. Sure, construction will always have its uncertainties—a sudden rain delay or a supplier glitch—but with solid habits and the right support, you can navigate them.

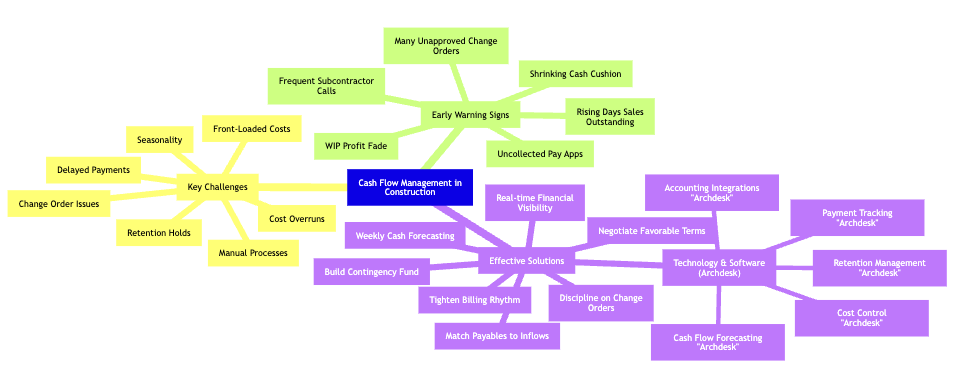

This mindmap illustrates the interconnected challenges, warning signs, and solutions related to effective cash flow management in construction.

Archdesk, with its focus on profitability analysis and cash flow insights, stands out by integrating everything from quoting to final billing. It doesn't just report problems; it helps prevent them. What's one step you'll take today to get a better handle on your company's cash?

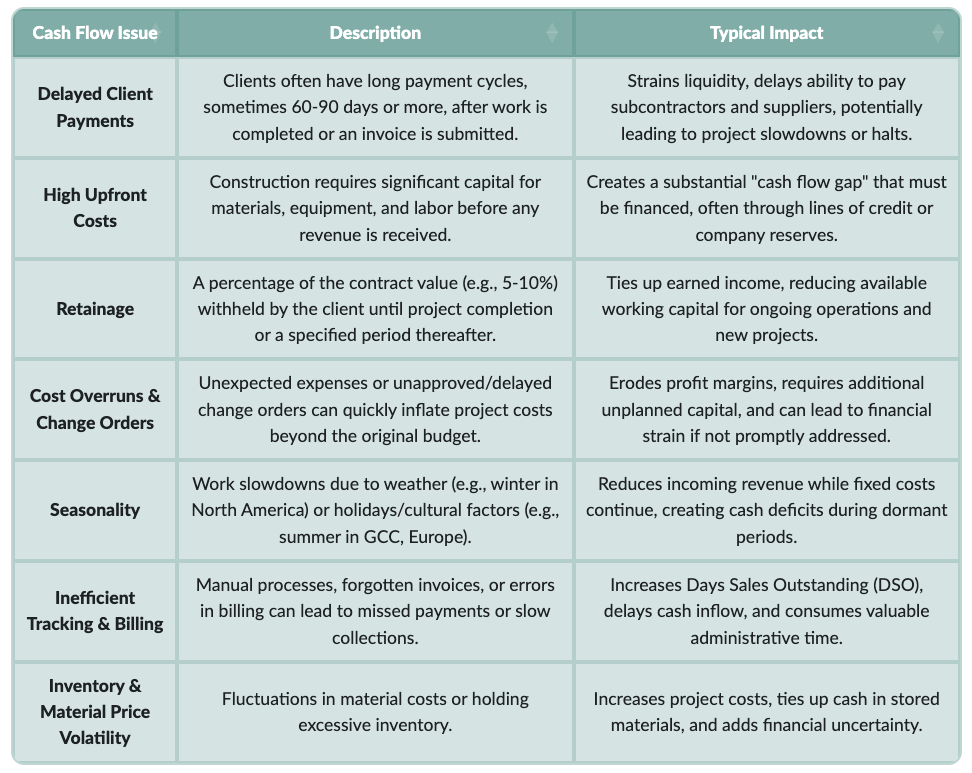

Common Cash Flow Issues and Their Impact

Let's break down some common issues that can plague construction cash flow and how they manifest.

Frequently Asked Questions About Construction Cash Flow

Why is cash flow such a big problem in construction?

Honestly, it's because construction projects require a ton of money upfront for materials, labor, and equipment, but payments from clients often come in much later, in stages. This creates a significant gap between when money goes out and when it comes in. Plus, things like retainage and unexpected cost overruns just make it trickier.

Can a profitable construction company still go out of business due to cash flow?

Absolutely. This is one of the most common pitfalls. You can be doing great on paper, with projects showing good profit margins, but if you don't have enough actual cash in the bank to cover immediate expenses like payroll or supplier bills, you can face serious liquidity issues. Cash is king, but cash flow is the kingdom!

What are the main signs my company might have a cash flow problem?

Keep an eye out for things like your Days Sales Outstanding (DSO) getting longer, frequent calls from subcontractors about late payments, or having too many unapproved change orders. If your cash reserves are shrinking and you're constantly scrambling to meet payroll, those are big red flags.

How can software help manage cash flow?

Modern construction management software, like Archdesk, centralizes all your financial data. It gives you real-time visibility into incoming and outgoing payments, helps you forecast cash flow for various scenarios, and automates payment tracking and retention management. This means fewer surprises and more informed decisions.

Is it really possible to negotiate better payment terms with clients?

It can be! While some clients are rigid, many are open to discussing terms like mobilization advances, shorter payment cycles, or even early release of partial retainage, especially if you can demonstrate efficient billing and clear project visibility. It often comes down to clear communication and a well-structured proposal.

Conclusion

So, the takeaway? Cash flow isn't just a finance department's problem; it’s the lifeblood of your entire construction operation. Ignoring it is like building a skyscraper without checking its foundation—it might stand for a bit, but eventually, it'll crumble. By understanding the unique challenges, recognizing the early warning signs, and leveraging powerful tools like Archdesk, you’re not just surviving; you’re setting your business up to thrive, project after project. Take control, gain clarity, and sleep a little easier knowing your cash is flowing right.

References

Archdesk Blog: Cashflow Management: Problems We Solve - Archdesk

Archdesk Solutions: Payment Tracking - Archdesk

Solving Construction Cash Flow Problems | Archdesk Blog - Archdesk

Construction Accounting 101: The Essential Guide (2025)

Construction Budget Management Software

The Ultimate Guide to Construction Financial Management ...

Unlocking Project Potential: Beyond Earned Value in Construction

How to Control Project Costs with Archdesk in 4 Steps ...

Construction Accounting Software | Solutions for Accountants

Unmasking the Unseen: How Visibility Shields Your ... - Archdesk

How To Manage & Improve Cash Flow in Trade and Construction | Xero US