Construction Tips, News & Best Practices

73 UK Construction Statistics and Trends

2022-2023 (So Far)

Danny Mitchell

Head of Content Marketing

If you're involved in the construction world, keeping up with data, trends, and events is essential.

In this article, we'll share UK construction industry statistics for 2023, a glance at previous years, and an overall construction forecast from the UK economy's perspective.

We'll also explore future trends like technology adoption, increasing green buildings, and the sector's status.

General UK Construction Industry Statistics

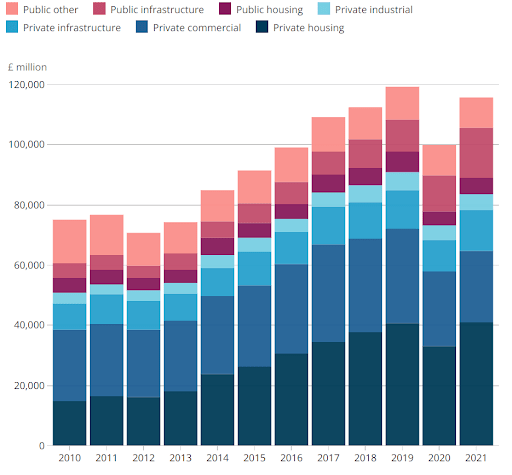

A graph showing the UK's construction output in millions between 2010 - 2021

- Yearly construction output remains below the pre-pandemic level in 2019 at current pricing. However, total new work increased by 15.3% in 2021.

- Only the private new commercial developments sector experienced negative output growth at 4.2%, which was still an improvement over 2020 when it decreased by 21.3% from the previous year.

- The residential sector has been reasonably robust recently, with output forecasted to increase by 6.4% in 2022. Unfortunately, it's predicted to decline rapidly in 2023 due to weak demand for new homes amid rising loan rates and material costs.

- Construction output is anticipated to increase by 2.8% in 2022 and 2.2% in 2023. Although this represents substantial growth, it's a downward trend from the Winter forecasts of 4.3% and 2.5%, respectively. Over the next 12 months, rising energy prices, commodity prices, and inflation as a result of Russia's invasion of Ukraine are likely to negatively impact construction demand and exacerbate cost inflation for construction-related goods.

- Infrastructure output is projected to increase by 4.6% in 2023, following an 8.8% increase in 2022.

- Private housing repair, maintenance, and improvement are expected to fall by 4.0% in 2023.

- The invasion of Ukraine by Russia has led to rising construction costs, which have impacted the industry as a whole. Consequently, inflation is expected to increase more than anticipated this winter, reaching a peak of 8.5% in April and averaging 6.8% for the entire year.

- The industrial sector is anticipated to experience the strongest growth rate, with output rising by 9.3% in 2023.

- In January 2023, the material price index for "All Work" grew by 10.4% compared to the same month the previous year. This resulted from an 11.2% rise in December 2022 over December 2021.

- When asked about their turnover in January 2023 compared to December 2022, 23.8% of active construction businesses reported a decrease, 50.9% reported no change, and 9.2% reported an increase.

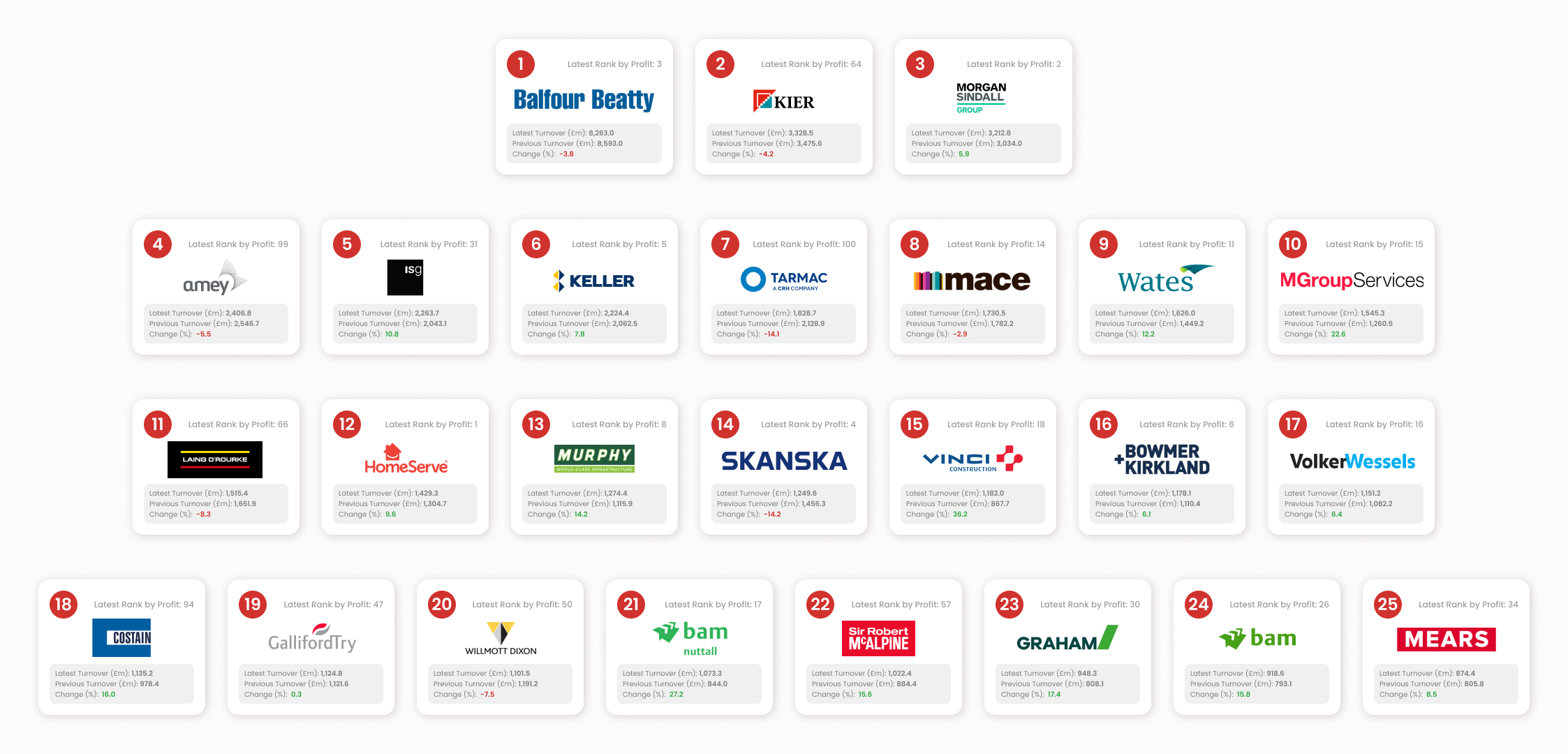

The Top 25 UK Construction Companies by Revenue

The top 25 construction companies by revenue using accounts available at Companies House on 29th July 2022.

UK Construction Employment Statistics

- Construction output dipped 1.7% in Dec 2022 compared to Dec 2021, marking the worst performance since June 2022. Economic uncertainty led to delays, cancellations, and less work, slowing down private housing output.

- Despite the UK facing an economic recession in 2023, an extra 225k construction workers could be needed by 2027, says the latest Construction Skills Network (CSN) report.

- Recruitment is mainly focused on private housing, infrastructure, repair, and maintenance.

- By 2023, the construction sector will add 168.5k jobs, 10k more than expected a year ago.

- Construction employment may reach 2.79 million in 2023, 2% down from the 2008 peak, according to the CITB.

- Post-Brexit, investor caution led to "significantly declining" commercial developments. Projections show the sector dropping dramatically this year, levelling out by 2023, and experiencing no overall growth.

Brexit's Impact on the UK Construction Industry 🇪🇺🇬🇧

A major concern when Brits voted to leave the EU was the impact on construction.

Only 15% of construction industry folks wanted to leave the EU, according to a pre-vote Smith and Williamson poll.

One reason for leaving was the potential reduction in administrative costs, ultimately paying for the EU exit.

But did that actually happen? Let's check the numbers:

- In July 2021, the volume of online job postings in London was 21% higher than in July 2020, with a 43% increase for construction and building trades, says the Office for National Statistics.

- The combo of Brexit, Covid-19, and the temporary Suez Canal blockage led to annual pricing hikes for many building supplies, including an 88% increase for iron and 25% for steel, according to June 2021 data.

- It's still uncertain how many EU citizens will return if construction employment in London increases after a decline of over 10% between March 2020 and 2021.

- In the year of the Brexit referendum, only 10% of UK construction workers were under 25, and around a third were over 50.

- Up to 10% of the sector's workforce consists of EU citizens, but that number is dropping. Between 2018 and 2020, the number of EU workers employed in London construction projects plummeted from 115,000 to 53,000.

- According to gov stats, 61% of imported building materials and components come from the EU, totalling £5.7 billion, up from £4.9 billion in 2015.

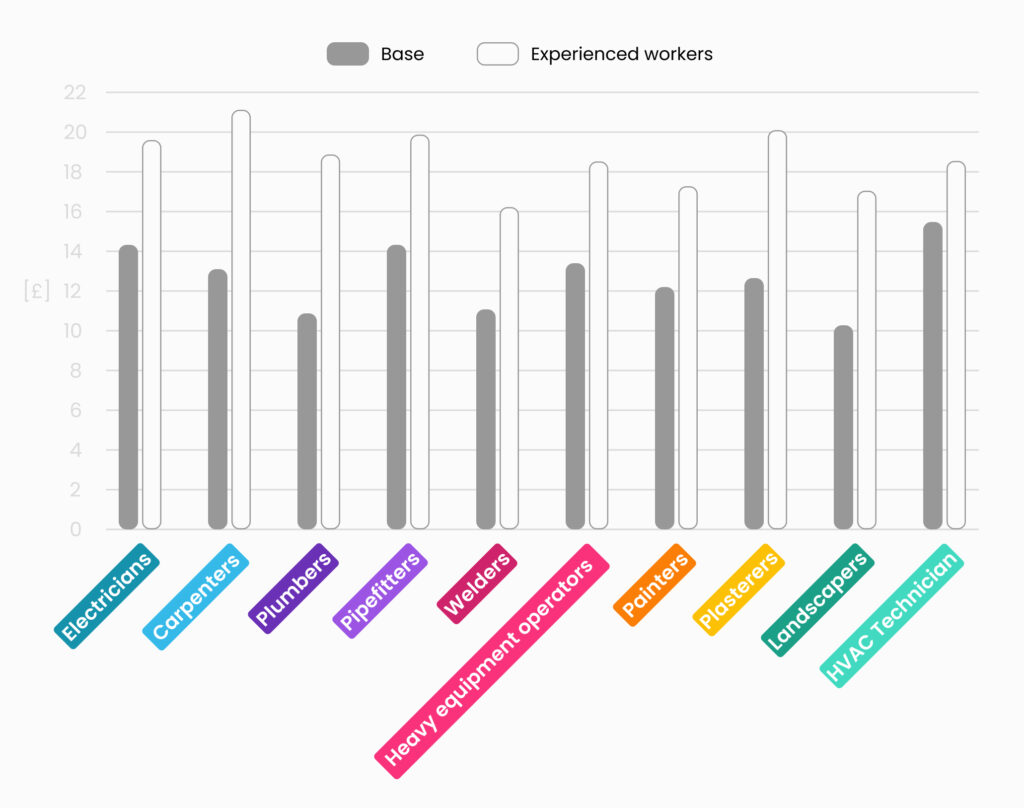

Average pay for UK construction tradespeople

A graph showing the average hourly rate for construction tradespeople

🔌 Electrician - £14.23/hr, up to £19.81/hr

🪚 Carpenter - £13.55/hr, up to £21.38/hr

🔧 Plumber - £10.96/hr, up to £18.73/hr

🚰 Pipefitter - £14.23/hr, up to £19.81/hr

⚡ Welder - £11.78/hr, up to £16.42/hr

🏗️ Heavy Equipment Operator - £13.77/hr, up to £18.45/hr

🖌️ Painter - £12.10/hr, up to £17.43/hr

🪵 Plasterer - £12.69/hr, up to £20.03/hr

🌳 Landscaper - £10.17/hr, up to £17.16/hr

🌡️ HVAC Technician - £35,505/year

Source: Payscale

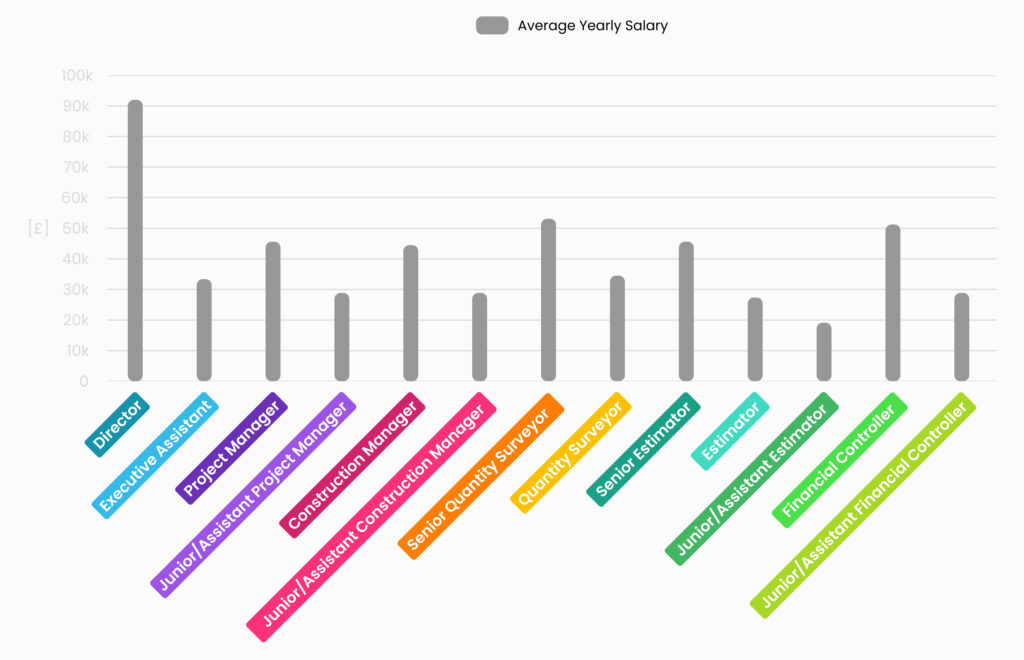

Average pay for UK construction management roles

A graph showing the average yearly salary for construction management roles

Keep in mind, these figures are average and can vary based on your experience and the type of work or project you're involved in.

Use these numbers to get a rough idea of the pay you can expect in the industry.

🏗️ Director - £92,829/year

📝 Executive Assistant - £33,066/year

📊 Project Manager - £46,496/year

👶 Junior/Assistant Project Manager - £29,827/year

🚧 Construction Manager - £45,814/year

🌱 Junior/Assistant Construction Manager - £29,827/year

📏 Senior Quantity Surveyor - £53,295/year

🔍 Quantity Surveyor - £34,827/year

💰 Senior Estimator - £46,488/year

🧮 Estimator - £28,748/year

🎓 Junior/Assistant Estimator - £19,968/year

💹 Financial Controller - £50,941/year

🧑💼 Junior/Assistant Financial Controller - £29,310/year

Source: Payscale

UK Construction Industry Stats & Trends 2023

- Payments in the construction sector often take 75-90 days. Past-due payments, payment plans, & insolvencies increased at double-digit rates in H2 2022, starting from a low level.

- Activity is expected to stay high through 2023, then dip by 3.9% and rebound by 2.0% in 2024, according to the Construction Products Association's Autumn Construction Predictions 2022-2024.

- Private housing new build output, the third-largest construction industry, has dropped since March 2022 after hitting a record £24 billion the previous year. House building targets are predicted to decrease by 4.0% in 2022 and 9.0% in 2023 before slightly increasing by 1.0% in 2024.

- Infrastructure output is anticipated to grow by 1.6% in 2023 and 2.6% in 2024, driven by major projects like HS2, Hinkley Point C, and Thames Tideway, despite cost overruns and delays.

- In 2021, the UK construction market was valued at $448.7 billion. Key construction sectors are expected to see annual average growth rates (AAGR) of over 1% between 2023 and 2026, supported by infrastructure initiatives for transportation, energy, housing, healthcare, education, and telecommunications.

- Building new factories and warehouses in the UK is predicted to boost construction output by about 3.

- Despite a challenging year ahead, 45% of respondents believe their companies will grow over the following year, while only 2% think their companies will "seriously decline", and 30% believe their company won't change dramatically during the impending recession.

UK Construction Industry Challenges

- Inflation & rising energy prices led to a 35.4% YoY increase in the timber price index (2021–2022).

- Higher energy costs make it tougher to complete projects on time & within budget.

- 73% of builders reported job delays due to material shortages, and 55% due to skilled labour shortages, according to the Federation of Master Builders' 'State of Trade Survey'.

- Top challenges for 2023 include labour cost management issues, lengthy estimating processes, and excessive time spent on reporting.

UK Construction Materials Statistics

- 98% of builders faced material cost increases in Q1 2022, with 83% passing these costs onto customers (FMB's 'State of Trade Survey').

- Brick deliveries dropped by 34.2% in January 2023 compared to January 2022 (seasonally adjusted).

- Concrete block deliveries decreased by 28.9% in January 2023 compared to January 2022 (seasonally adjusted).

- Sand and gravel sales fell 2.5% in Q4 2022 compared to Q3, with sales generally below pre-2008-2009 recession levels due to the Covid-19 pandemic (seasonally adjusted).

UK Construction Labour Statistics

- With baby boomers retiring and fewer young people entering the workforce, construction businesses will need an additional 250,000 workers by 2026 to keep up with demand.

- 35% of construction companies faced labour shortages by mid-July 2022 (Office for National Statistics).

- Annually, an average of 59,000 non-fatal worker injuries and 78,000 work-related illnesses occur, with no significant change from the previous year.

UK Construction Technology Statistics

- By 2023, modular construction, which can reduce construction time by 50%, save $22 billion, minimize waste, and increase productivity, is expected to become the norm.

- 58% of respondents use software for payroll and HR management, while 65% have used it for estimating and pricing.

- Only 9% use project management software for site management, while 10% use end-to-end ERP software.

- ERP software, training software, and estimating & pricing software are the top three software products contractors plan to purchase in the coming year.

- The built environment may account for up to 40% of the nation's carbon emissions, according to UK research. As a result, green and sustainable development will continue to be a major trend through 2023.

UK Construction Industry Forecasts 2023

- The construction industry in the UK is predicted to grow by 4.4%, reaching £163,253 million in 2023.

- Despite near-term concerns in several construction sectors, the UK's medium to long-term growth is expected to continue over the projected period, posting a CAGR of 3.9% from 2023 to 2027.

- UK construction output is forecasted to reach £190,146.5 million by 2027.

- To curb inflation, the Bank of England announced a series of interest rate hikes for 2022. Inflation is affecting many people's monthly budgets nationwide and slowing down housing construction. This trend is expected to continue into H1 2023. As a result of these rate increases, mortgage rates have risen.

- Two emerging trends for 2023 include the shift towards modern construction techniques and the focus away from traditional on-site skilled labour to automated, off-site modular structures.

Do you want to talk about construction?

If you're reading this article, you either:

- love construction

- needs statistics for content like an article, video or paper

- want to stay abreast of the latest in the industry

- Something else I can't think of right now

You should reach out to me on LinkedIn if you fall into any of those categories. I'd genuinely like to know why you're here and to chat about construction with you.

Find me on LinkedIn or email me on [email protected]

You might also like

February 29, 2024 • 7 min read

Utilizing the human-first approach to construction projects to drive higher results.

July 3, 2023 • 6 min read

8 Best Construction Drawing Management Software (2023): A Comprehensive Guide

Find all the information you need about the construction drawing management software tools available on ...June 14, 2023 • 6 min read

The 11 Best PlanGrid Alternatives (2023)

Looking for a great alternative to PlanGrid software? Check out the 11 best construction software tools ...June 14, 2023 • 4 min read

How to win at CIS 340 and make taxes a breeze

CIS 340 is a legal obligation for contractors. But getting it right isn’t straightforward. Want ...