Construction Tips, News & Best Practices

Your Guide to Construction Work-in-Progress Reporting

Construction Accounting 101 (2023)

Working in construction can often feel like an exercise in educated guesswork.

Even the best project managers can be defeated by circumstances outside of their control, be it weather, no-show deliveries or unavailable subcontractors.

And once the wheels start to come off the proverbial digger, your budget and timescales are at risk.

So, here’s the issue:

Making a profit in construction requires predicting the unpredictable. So how do you do that? The solution lies in construction work-in-progress reporting.

How does it work? Here's what we'll cover:

- Why do WIP reports matter

- The dangers of over and under-billing

- What is a construction WIP report?

- What should you include in a WIP report?

- How to calculate your cash flow

- WIP calculation methods: Step by step

- What to avoid when creating a WIP report

Why do WIP reports matter?

One of the biggest challenges in construction accounting is that income and their corresponding expenses rarely occur in the same billing period.

That makes it difficult to track your budget because you’re often not looking at the whole story.

Consider this example: Let’s pretend you own a building company called Cornerstone Construction and you’ve billed your client, say, £100,000 in the last month.

But looking at your balance sheet, you realise the costs over the same period are only £50,000 – much less than the projected £90,000.

In short, the project is now massively over-billed. Quids in, you think – turns out this project is going to be more profitable than you thought!

If only life were so simple…

Check out our recent rundown on construction accounting to find out more about construction accounting processes.

The dangers of over and under-billing in the construction industry

The truth is that over-billing is much more of a red flag than it originally looks.

The most likely explanation is that the work hasn’t been completed yet, meaning you could be in for a shockingly high bill later when all those extra costs get spent.

It could also indicate that the work is moving too slowly – meaning you may end up blowing your timescale and budget at the end of the project.

So, what does this have to do with work-in-progress reporting?

In short, your WIP report is your opportunity to work out how on track your construction projects are from month to month, so you can rectify issues and avoid ugly surprises later on.

What is a construction WIP report?

So all this begs the question: What are construction WIP reports – and how does it help you keep track of your project’s balance sheet?

In essence, the goal is to compare the total expenses so far with the total projected expenses of the project, to work out whether or not you are under or over-billed.

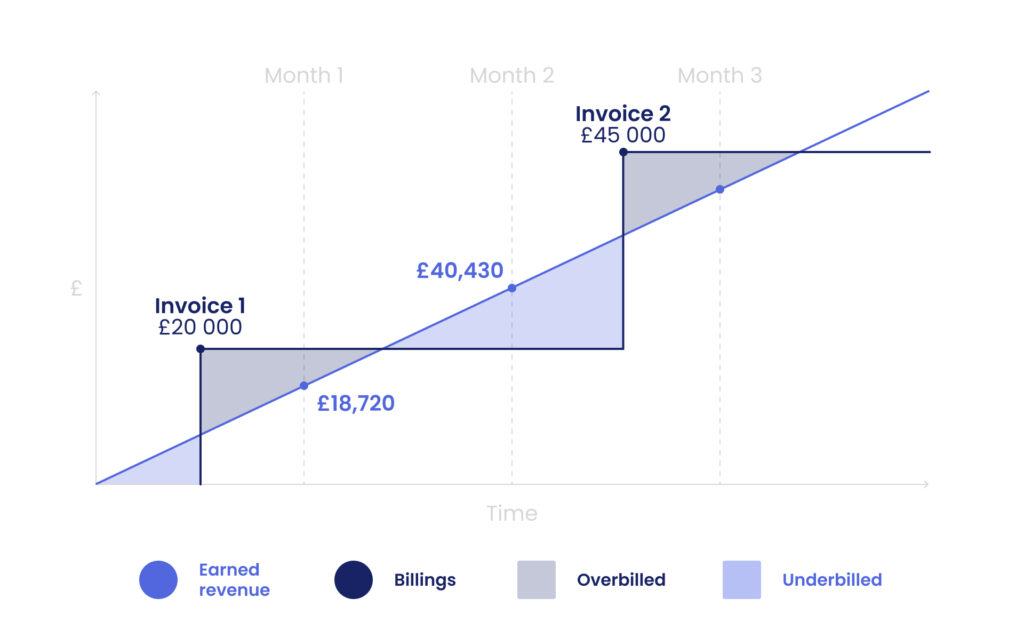

- Under-billing happens when you haven’t charged enough money to cover the costs within the billing period.

If you’re under-billed, it might just mean that you’ve spent more of the budget up-front than anticipated. It could also mean that the project is running over budget, which could end up eating into your cash flow later in the project. - Over-billing happens when you’ve charged more than you’ve used. This could mean that you’ve overestimated costs and the project is under budget.

The more likely explanation, however, is that the project is running behind or that those expected costs will appear in a later billing period.

Over or under-billing can be perfectly innocent or a massive red flag – depending on the project you’re working on.

Most building work will start over-billed, for instance, as clients are generally expected to pay a deposit up-front before work begins.

But it’s important to know why you’re producing the figures you are - so you can find and resolve potential issues before they start to send your project off the rails.

What should you include in a WIP report?

For WIP reports to work properly, there’s a certain amount of information it’s important to give.

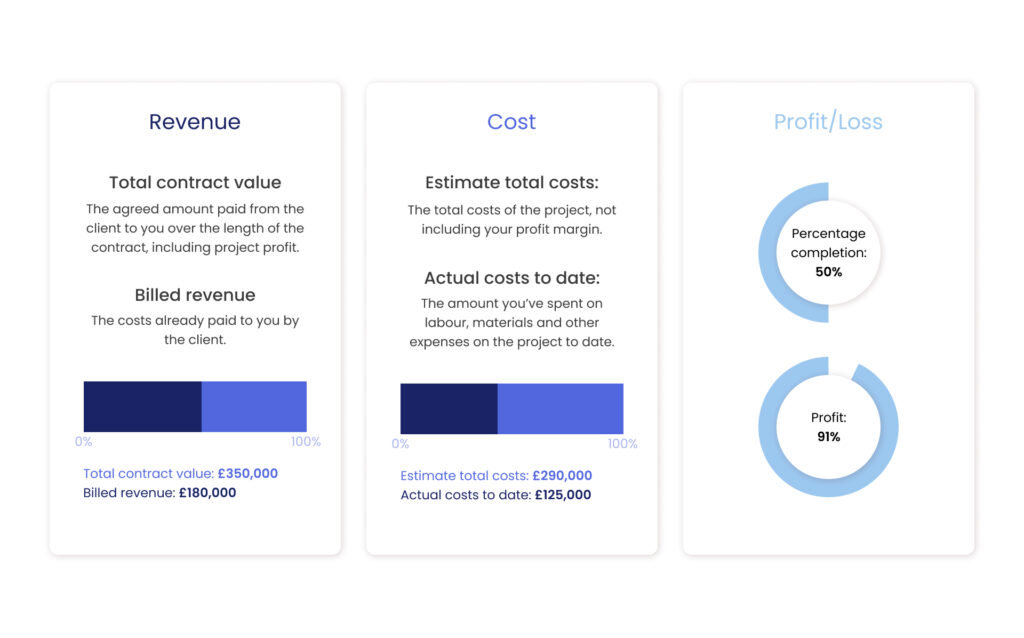

First, you need to recap the original projected costs of the project, including:

- Total contract value: The agreed amount paid from the client to you over the length of the contract, including project profit.

- Estimate total costs: The total costs of the project, not including your profit margin.

Then, you need to include details of actual spend-to-date – so you can compare the reality against the projection:

- Actual costs to date: The amount you’ve spent on labour, materials and other expenses on the project to date.

- Billed revenue: The costs already paid to you by the client.

This will then allow you to produce figures to assess how on track the project is. These include:

- Percentage completion: How far through the project you are.

- Earned revenue: Your profit to date.

- Over/under-billing: Whether you have spent more or less than the allocated budget so far.

These figures will help you understand if your project is on track and whether profits are at risk. Then you can use that information to proactively spot any issues.

How to calculate your cash flow

When it comes to your WIP report, there are three main metrics you need to calculate:

Percentage completion

The percentage completion is quite simply a proportion of the total project value you’ve already spent. You can calculate it like this:

- Actual costs to date ÷ Total contract value

Earned revenue

You can use the percentage completion to then calculate your estimated profits to date:

- Percentage completion x total estimated profit

Over/under-billing

From there, you can deduce how on track your budget really is:

- Billed revenue – costs to date – earned revenue

If the resulting number is above 0, the project is over-billed, if it’s under, then you’re under-billing.

WIP calculation methods: Step by step

To see the WIP report in action, let’s return for a moment to Cornerstone Construction and consider how these calculations can help us produce a more accurate overview of our project.

Let’s assume the following estimated cost outline was created at the start of the project:

- Total contract value: £200,000

- Estimate total costs: £180,000

Now, one month in, the actual spent cash flow looks a little more like this:

- Actual costs to date: £50,000

- Billed revenue: £100,000

From this, therefore, we can calculate:

- Percentage complete = 25%

- Earned revenue = £5,000

- Over/under-billing = £45,000 (Overbilled)

In short, you’ve used about half the budget you expected, and the project is now £45,000 over-billed.

With the project being only 25% complete, you can calculate your profit share thus far as £5,000 – 25% of the total expected profit.

Compare that to where we were at the start, when a simple calculation of £100,000 (Total billed) - £50,000 (Total spent to date) made your profit margins look a lot healthier than they actually are.

So where do you go now? What’s the solution to over/ or under-billing and how do you get your project back on track?

Unfortunately, the solution here is often a lot more difficult to define.

There could be plenty of reasons why a project is over or under-billed, some sensible, others worrying.

The key is to discuss the WIP report with your Project Manager to understand more about the situation on the ground.

From there, you can determine whether you need to change your plan to get the project on track, or whether you can expect next month’s finances to make up the difference.

What to avoid when creating a WIP report

When building your WIP reporting, there are a few pitfalls you need to watch out for:

Irregular reporting

For WIP reports to do their job, you need to create them regularly, ideally weekly, fortnightly or monthly – depending on the length of the project.

Otherwise, you run the risk of identifying problems too late in the process to fix them.

Mistakes in the report

If you’re relying on Excel or a similar spreadsheet tool, it can be easy to enter figures wrong or end up with strange results due to broken formulae.

Double-check the figures and, if in doubt, employ the ‘smell test’: If it feels wrong, it probably is.

Assuming over-billing = profit

As we discovered at Cornerstone Construction, over-billing isn’t necessarily a good thing.

If you assume the funds are profit and spend them accordingly – you could be left with significant liability later down the line. Instead, always use the earned revenue method to work out your actual profits.

Using outdated information

When creating your report, use the most up-to-date figures available.

If the data is a few days or even weeks out of date, you’ll lose the opportunity to spot issues that might have arisen in the meantime.

It’s always a work in progress

Accurate WIP reporting might seem confusing at first – but it is possible to get it right.

However, if you’re doing much of the reporting on Excel, other spreadsheets, or even paper – there’s a good chance that mistakes will creep in that you’ll struggle to spot.

That’s why it’s so important to ensure you’re using the right technology to support your WIP reporting and construction accounting processes.

Frequently Asked Questions (FAQs)

Why is the project manager crucial to the WIP process?

A Project Manager can help give you the valuable context behind the numbers in your WIP reports. Crucially, they can help you understand why you are under or over-billing, so you can understand how to get the project back on track.

How to create a WIP report

To create a WIP report, first add the total contract value to date, estimated costs, actual cost to date and total billed revenue. From there, you can calculate the percentage completion, earned revenue and whether the project is over or under-billed.

What are the WIP best practices?

To make sure your report is on track, always double-check your figures, make sure you’re using the most up-to-date data, report regularly and never assume that over-billing = profit.

What is construction-in-progress

Construction-in-progress, or work-in-progress reports, are a type of regular accounting that construction firms use to understand whether ongoing projects are on budget.

What is an example of construction-in-progress

Let’s pretend you’re working on a building project for Cornerstone Construction. Construction-in-progress, or work-in-progress reports, help you track your income and expenditure throughout the project to understand whether you’re under or over-billing.

Does WIP include labour?

Work-in-progress reporting should include any details of expenditure you’ve spent. That includes material costs, subcontractors and labour.

You might also like

February 29, 2024 • 7 min read

Utilizing the human-first approach to construction projects to drive higher results.

July 3, 2023 • 6 min read

8 Best Construction Drawing Management Software (2023): A Comprehensive Guide

Find all the information you need about the construction drawing management software tools available on ...June 14, 2023 • 6 min read

The 11 Best PlanGrid Alternatives (2023)

Looking for a great alternative to PlanGrid software? Check out the 11 best construction software tools ...June 14, 2023 • 4 min read

How to win at CIS 340 and make taxes a breeze

CIS 340 is a legal obligation for contractors. But getting it right isn’t straightforward. Want ...